Social Unrest May Cause a Rapid Uptick in This $0.25 Stock

Today I’d typically send you a Trade Talk Tuesdays video message…

But due to what we’re seeing play out across many of our major cities, I felt that it would be far more appropriate to step back and issue you a timelier and more critical message.

So let’s begin…

Like most of you, I found myself waking up this morning and asking, “What happened overnight?”

Peaceful protests by day turned into violent protests by night – and fear is gripping the country.

As heartbreaking and unfortunate as it is to see our cities broken and battered, as investors, we must play these trends in the best ways possible.

So today I’ll share my list of top personal defense stocks.

As you know, gun stocks have already been rallying in recent months.

The Washington Post reports, “Gun Sales Surge 80% in May.”

If those were the May numbers, just wait until the June numbers come out.

So right now, the idea is clear…

Fear-based safety purchases in the midst of social unrest could give the following sector an added boost.

I think this is a trend that’ll extend in the days and weeks ahead.

So here are my so-called “social unrest plays.”

American Outdoor Brands (Nasdaq: AOBC)and Sturm, Ruger & Co. (NYSE: RGR) both sell firearms, which are pure plays on self-defense and protection right now.

Axon Enterprise (Nasdaq: AAXN) makes nonlethal stun guns and body cameras used by law enforcement. You may recognize this company’s previous name, Taser International. The company changed its name in April 2017.

Vista Outdoor (NYSE: VSTO) makes ammunition, scopes and CamelBak water drinking products – which are now getting lumped into the “social unrest” category.

All four of these names remain “in play” for the immediate and foreseeable future.

There’s another tiny stock that I’d also like to bring to your attention…

You see, late last night, I found myself Googling “Who makes pepper spray?” – as Amazon is reporting explosive sales.

The answer is Sabre, the world’s largest pepper spray manufacturer, who provides police-strength protection to consumers and law enforcement alike.

However, Sabre isn’t publicly traded (and please don’t be confused – there is indeed a “Sabre Corp.” that trades on the Nasdaq, but it operates in the travel and tourism sector).

I bring this up because the fifth-bestselling pepper spray in the country is made by Mace Security International (OTC: MACE).

It’s a $0.25 stock that trades over the counter (OTC).

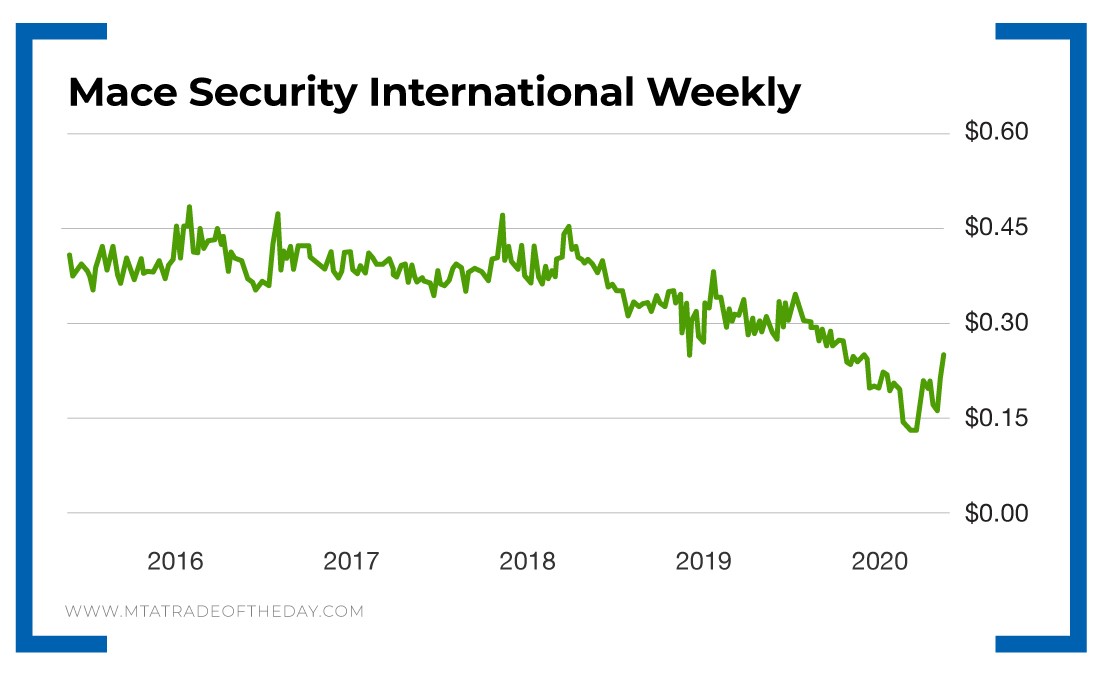

I admit, this stock hasn’t done anything for years. Its five-year weekly chart is as boring – and as unprofitable – as you’d ever see.

However, if there were ever a time to see a rapid uptick in Mace Security International sales, that time is now.

Action Plan: If there were ever a time to see a rapid uptick in Mace Security International sales, that time is now. So while I’m not “officially” recommending this play, I do feel compelled to at least bring it to your attention. Adding some shares between $0.25 and $0.35 just might be logical right about now.

Social Unrest Winners: This morning in The War Room, we used our list of “social unrest plays” above to lock in a 48% winner in less than seven minutes. If you’d like to start hitting these daily winners (300 of them, to be exact), then you’re invited to join me in The War Room!

About Bryan Bottarelli

Whether it was selling the Star Wars figures he collected as a little boy for 50 times their value or using the $125 he made cutting grass to buy a Michael Jordan rookie card that he later sold for $1,500, it was always clear that Bryan Bottarelli was a born trader – possessing the unique ability to identify opportunities and leverage his investments.

Graduating with a business degree from the highly rated Indiana University Kelley School of Business, Bryan got his first job out of college trading stock options on the floor of the Chicago Board Options Exchange (CBOE). There, he was mentored by one of the country’s top floor traders during the heart of the technology boom from 1999 to 2000 – trading in the crowded and lively Apple computer pit. Executing his trades in real time, Bryan learned to identify and implement some of his most powerful trading secrets… secrets that rarely find their way outside the CBOE to be used by individual traders.

Recognizing the true value of these methods, Bryan tapped into his entrepreneurial spirit and took a risk. He walked off the CBOE floor and launched his own independent trading research service called Bottarelli Research. From February 2006 to December 2018, Bryan gave his precise trading instructions to a small, elite group – most of whom have been followers ever since.

As a “play tactician,” Bryan uses his hands-on knowledge of floor trading to shape opportunities and chart formations into elegant, powerful and profitable recommendations. And by using the same hedging techniques taught by professional floor traders, Bryan is able to deliver his readers remarkable gain opportunities while strictly limiting their total risk.

Along the way, Bryan has developed a cumulative track record that could impress even the most successful hedge fund manager.

He now spends his days moderating one of the most elite trading research forums ever created: The War Room.