Here’s Why You Should Be Optimistic

In this article Senior Markets Expert and Financial Host Matt Benjamin examines the turnaround the U.S. economy has seen in recent months and the resulting stock market boom.

When looking at the most recent economic data, it’s best to apply Occam’s razor. That is, the simplest and most straightforward explanation is probably the correct one. And when it comes to economics, Occam’s razor would lead us to believe that we’re at the beginning of a boom, one that investors can’t afford to ignore.

Time To Play the Stock Market Boom

In fact, the data also suggests that it’s time for investors to tweak their portfolios to take advantage of this boom.

But first, consider a few facts and figures…

- Last Friday, the U.S. Bureau of Labor Statistics reported that the U.S. economy created a net 916,000 new jobs in March – the biggest increase in seven months. And the sector hit hardest by the pandemic, leisure and hospitality, added the most jobs in March – about 280,000.

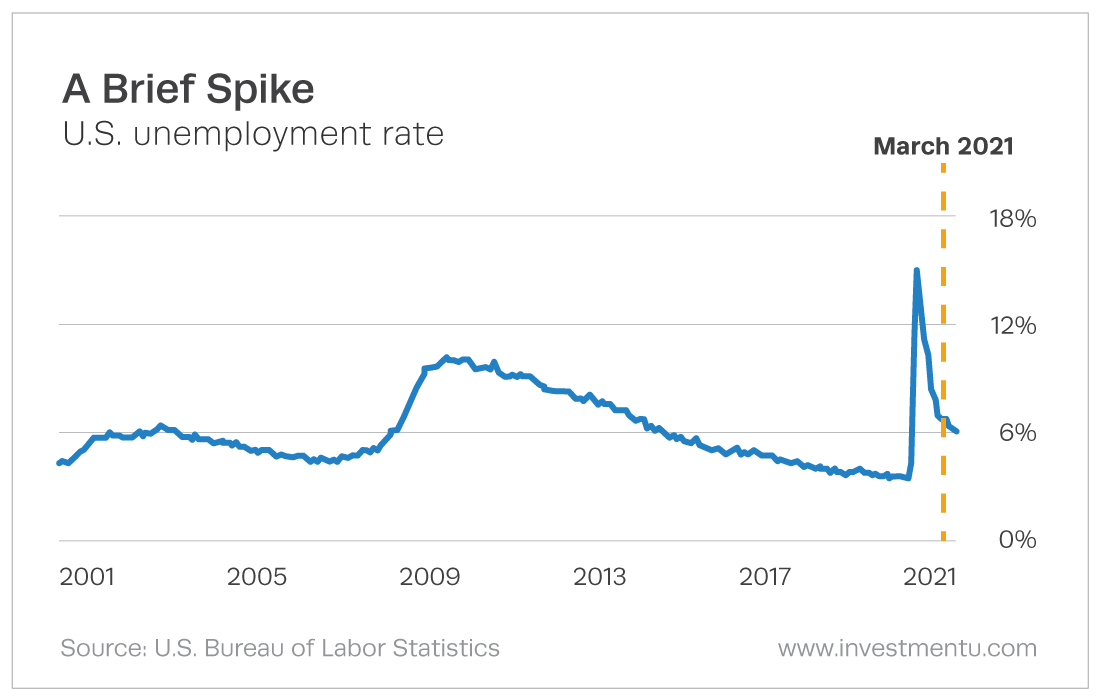

- The unemployment rate dropped back to 6% last month, after spiking to 14.8% in April of last year. Sure, there’s still a way to go to get back to the 3.5% rate we enjoyed just before the pandemic, but the trend suggests we’re well on our way. This is illustrated best with a chart…

- The rollout of COVID-19 vaccines in the U.S. is really starting to hum. According to the Centers for Disease Control and Prevention, 3 million doses were administered on each of the first four days of this month and 4.1 million vaccine doses went into arms on Saturday, a one-day record.

- Recent government surveys show that confidence among both consumers and manufacturers is soaring. Economies run on confidence, and these numbers suggest businesses and consumers are itching to spend money.

- More stimulus is likely on the way. It’s not clear exactly what the infrastructure bill now being debated in Washington, D.C., will ultimately look like, but one will likely be passed in some form. And it is also likely to have between $1 trillion and $2 trillion in new spending, which will be a huge boon for multiple industries.

- The Federal Reserve, ordinarily charged with taking away the punch bowl just as the party gets going, is instead signaling it will continue to ladle that rum punch into cups well into the future.

There is really only one way to interpret all that data…We are at the beginning of an economic boom.

Take Advantage of This Stock Market Boom – Act Now

So what should investors be doing to prepare for this boom? Well, first and foremost, they need to own stocks.

And Chief Investment Expert Alexander Green points out that while stocks can be volatile, you shouldn’t be scared away from them.

“Volatility is simply the price of admission for stock investors,” Alex writes. “If you could own a passbook savings account that gave equity-like returns, everyone would do it. But you can’t. You have to own stocks.”

Second, you need to consider which sectors or types of stocks will thrive in this next economic stage as the pandemic finally recedes and the economy blossoms.

The so-called pandemic stocks, like Amazon (Nasdaq: AMZN), Alphabet (Nasdaq: GOOGL) and Netflix (Nasdaq: NFLX), had a great run as they benefited from the long lockdown.

New sectors, however, are now poised to take the baton. These include “recovery stocks,” many of which are in the rebounding leisure and hospitality sector (see the first of our facts and figures above).

In addition to recovery stocks, small cap stocks are poised for a breakout. Many small cap companies are in the services sector, which looks poised to gain quite a bit from the economic reopening. And we’ve got your guide to small caps right here.

Venture Abroad

Finally, a good argument can be made for foreign stocks right now. The U.S. stock market is fairly overvalued compared with those of other countries (i.e., U.S. stocks are very expensive relative to their earnings).

This is a bit of a longer-term play than small cap and recovery stocks. The U.S. super-stimulus and strong vaccine rollout suggest that domestic stocks may continue to outperform non-U.S. equities in the near term. But other factors, including a widening U.S. trade deficit and an increasingly weak dollar, should boost non-U.S. stocks in the medium term. So it’s time to increase your exposure to stocks of companies outside the U.S.

So go ahead, be optimistic. You’re allowed. But you should also make the changes to your portfolio that set you up to benefit from the coming stock market boom.

And if you want to hear Alex’s take on this economic boom and how it will generate more wealth in the next two years than the previous two decades – as well as how to benefit from it – just click here.

Don’t forget, Alex bet on Netflix at a split-adjusted price of $1.62 and Amazon at $35, well before either was a blip on anyone’s radar.

In other words, he’s the guy you want to be following.

Will The Stock Market Boom Continue? To find out the answer to this question and more, sign up for our free Investment U e-letter today and start making smarter, more profitable investments.

About Matt Benjamin

Matt has worked as an editorial consultant to the International Monetary Fund, the World Bank, the Economist Intelligence Unit and other global macro-institutions. He wrote about markets and economics for U.S. News & World Report, Bloomberg News and Investor’s Business Daily, among other publications. He also worked for several years as head of political economy for a Financial Times-owned macroeconomic consulting firm, advising hedge funds around the world. Matt’s claim to fame is that he’s interviewed two U.S. presidents and has spoken with five Federal Reserve Chairs from Paul Volcker through Jerome Powell. Matt also served as The Oxford Club’s Editorial Director for two years.