Three Companies I Like: Costco, Walmart and Walgreens (Here’s the One to Play Now)

Let’s get started on today’s Trade of the Day…

Two stocks that members have played before in The War Room – and that I continue to like – are Costco and Walmart.

Right now, the Costco options premiums are insane – which could open the door for you to trade Walmart.

You see, right now, after years of preparation, Walmart’s online grocery business is having its so-called “big moment.”

Here in the new “virus economy,” online grocery shopping has surged – and Walmart stands to capitalize.

Its curbside pickup, which requires less human contact, could make it the primary e-grocer in America.

Right now, Walmart is capturing a massive 58% market share of new e-grocer customers.

Look at these stats…

Walmart has 3,200 locations that allow you to pick up groceries curbside, and 1,600 of those locations deliver straight to your door.

Plus, 90% of Americans live within 10 miles of a Walmart – and 56% of Walmart’s sales are now from groceries.

When it comes to a winner, it sure looks like Walmart is ready to be the new Amazon of this virus economy.

Here’s another thought…

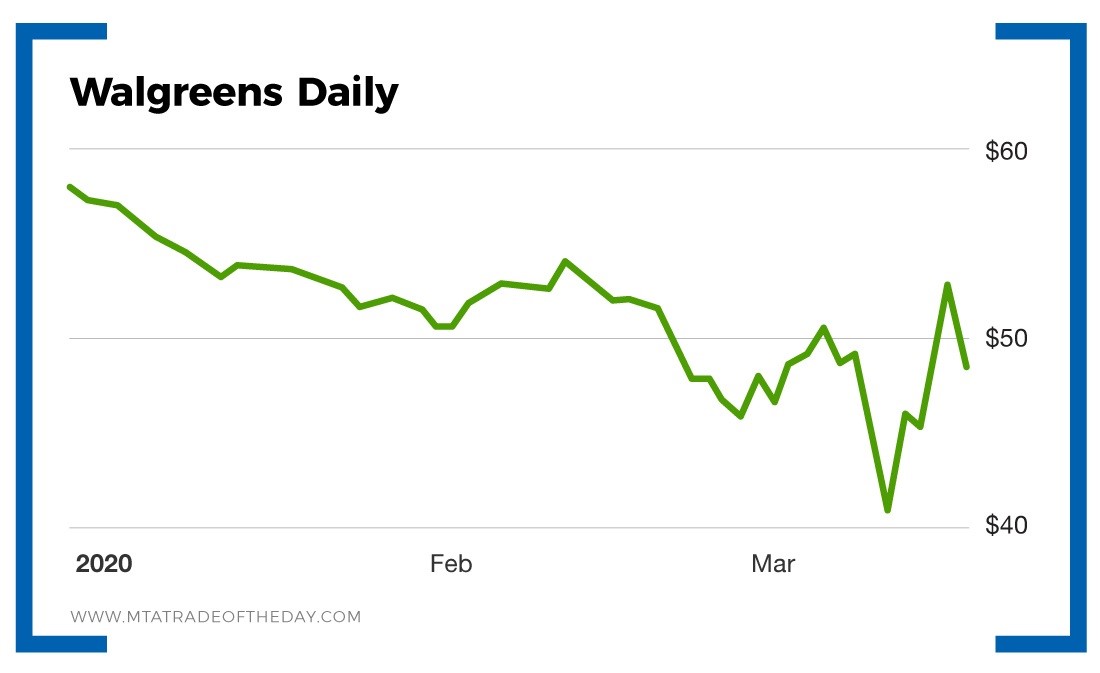

As soon as America finally decides to take this virus seriously, which I think is now starting to happen, you could see a run of people going to Walgreens (Nasdaq: WBA) to stock up on healthcare supplies – similar to what we saw people doing with toilet paper last week.

If and when that happens, Walgreens should receive a bump – and some safe-haven buying interest.

The key word here is “should.”

Action Plan: Given how Costco and Walmart have popped recently, I like the idea of using this pullback on Walgreens to establish an upside position going into April.

If Walgreens follows suit, this could be another safe-haven winner in the midst of this market madness.

About Bryan Bottarelli

Whether it was selling the Star Wars figures he collected as a little boy for 50 times their value or using the $125 he made cutting grass to buy a Michael Jordan rookie card that he later sold for $1,500, it was always clear that Bryan Bottarelli was a born trader – possessing the unique ability to identify opportunities and leverage his investments.

Graduating with a business degree from the highly rated Indiana University Kelley School of Business, Bryan got his first job out of college trading stock options on the floor of the Chicago Board Options Exchange (CBOE). There, he was mentored by one of the country’s top floor traders during the heart of the technology boom from 1999 to 2000 – trading in the crowded and lively Apple computer pit. Executing his trades in real time, Bryan learned to identify and implement some of his most powerful trading secrets… secrets that rarely find their way outside the CBOE to be used by individual traders.

Recognizing the true value of these methods, Bryan tapped into his entrepreneurial spirit and took a risk. He walked off the CBOE floor and launched his own independent trading research service called Bottarelli Research. From February 2006 to December 2018, Bryan gave his precise trading instructions to a small, elite group – most of whom have been followers ever since.

As a “play tactician,” Bryan uses his hands-on knowledge of floor trading to shape opportunities and chart formations into elegant, powerful and profitable recommendations. And by using the same hedging techniques taught by professional floor traders, Bryan is able to deliver his readers remarkable gain opportunities while strictly limiting their total risk.

Along the way, Bryan has developed a cumulative track record that could impress even the most successful hedge fund manager.

He now spends his days moderating one of the most elite trading research forums ever created: The War Room.