Harnessing the Flux: Trading Volatility With Options

Many investors shudder at the thought of volatility. But for day and swing traders, price swings are like fuel. And it’s not just short-term traders who can benefit. With a little know-how, it’s possible to supplement your income by trading volatility with options.

Let’s start with the basics. When it comes to options, there are two types of volatility: historical and implied. Historical volatility is a measurement of how much the price of a given security has moved in the past. Implied volatility measures how big the price movements are expected to be in the future.

Implied volatility considers past price fluctuations as well as outside events that can have an impact on a security’s price. For example, earnings season usually raises volatility levels. Federal Reserve meetings can, too. Then there are other factors, like pandemics or severe weather events.

Now, when it comes to options trading, volatility is priced in. If a stock’s price has been all over the place, options contracts associated with it will be more expensive. But for slow-moving stocks that are relatively stable, options prices are cheaper.

To put it another way, you want to buy options contracts when volatility is low… and sell when volatility spikes. The trick here is to figure out what the implied volatility level is currently at and compare that with historical levels.

A Closer Look at Volatility

Let’s look at the volatility chart of the relatively stable Microsoft (Nasdaq: MSFT) using the website ivolatility.com.

As we can see, the historical and implied volatility levels move in tandem for the most part. But when they diverge – even slightly – that can signal an opportunity. When implied volatility levels are below historical levels, that means that options at the money should be selling at a discount.

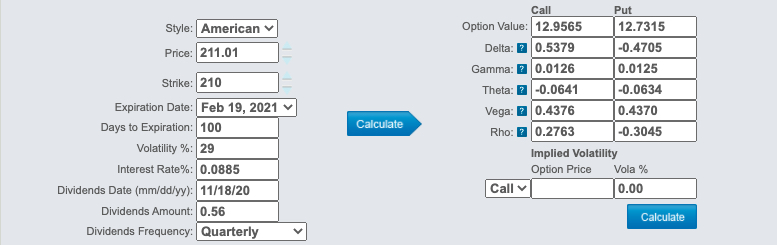

Let’s take a closer look at how volatility levels can impact the price of an options contract. Looking at the chart above, we can see Microsoft has an implied volatility level around 29%. Then we’ll take advantage of another free tool from ivolatility.com. Using its options calculator, we can determine what a fair price for call or put contracts would be.

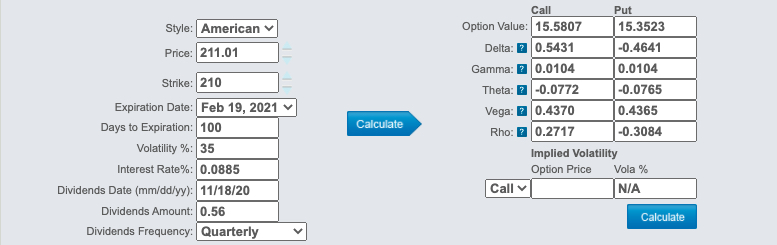

WIth a volatility level of 29%, February 2021 $210 calls are priced at $12.95 per contract. And looking at the same contracts using historical volatility levels, we can see that this is cheap by comparison.

As you can see, volatility has a direct impact on the price of options contracts. A few percentage points can mean the difference of a few bucks per contract. Now that you know to look at volatility levels before trading options, here’s how to use this information.

Buy or Sell: How Trading Volatility With Options Adds Up

When volatility is low, it’s a buyer’s market. When it’s up, it’s time to sell. While it’s easy to see when volatility is low, it can be tough to predict when it will rise. But even based on these simple metrics, it’s still possible to make a smart options play.

As mentioned above, Microsoft’s volatility levels are currently relatively low. That means it might make sense to buy options at this time. Because they’ll be sold at a discount. But back in March and April, when volatility was at its height, there was still money to be made.

If you were interested in owning shares of Microsoft, It would have been a great time to sell put options. A trader could have earned a handsome premium from the transaction. And if the share price fell to the desired strike price, it would have been possible to get those shares at a reasonable discount.

But this is only the beginning of the ways to make money trading volatility with options. Once you understand volatility, there are lots of other ways to benefit. Here are two of the most common.

Possibility One: The Straddle

When you’ve found a security with high volatility, the idea here is to buy a call and put option contract on that underlying security. Both should have the same strike price and expiration date.

As long as volatility goes up, it can net a tidy profit no matter which direction the price of the underlying stock goes. For instance, if a $40 stock rose 12.5% to $45 before the expiration date, the put contract would expire worthless. But the call option should pay off enough to offset the loss and still turn a profit. As you can see though, high volatility is key for this to work. Should the price remain steady or only edge up or down a few percentage points, one contract would expire worthless. And the other wouldn’t be valuable enough to offset the cost of buying both options.

Possibility Two: The Strangle

For this, once again we’ll be employing two options contracts. This time they will both be near the current price of the stock, but out of the money. Because both contracts are out of the money, this can be a cheaper alternative to the straddle.

As long as volatility goes higher, no matter which way the underlying stock goes, it should make money. And this strategy is often used on stocks with high levels of volatility. Because both options contracts start out of the money, you need even bigger fluctuations in price to benefit.

Trading Volatility With Options: The Bottom Line

Volatility plays an enormous role in options trading. And being able to spot highs and lows will put you well on your way to becoming a successful trader. There are lots of ways to play a stock with lots of volatility.

A more basic takeaway is that when trading volatility with options, you want to buy contracts when implied volatility is expected to go up. And when volatility is high and it’s expected to go down, this is the time to write contracts and sell options.

But these are only some of ways to take advantage of volatility. If you’re interested in learning more trading strategies and putting them to work, sign up for the free Trade of the Day e-letter below. You’ll receive daily market news and play-by-play recommendations.

Read Next: How to Short Volatility – A Strategy Poised for a Comeback

About Matthew Makowski

Matthew Makowski is a senior research analyst and writer at Investment U. He has been studying and writing about the markets for 20 years. Equally comfortable identifying value stocks as he is discounts in the crypto markets, Matthew began mining Bitcoin in 2011 and has since honed his focus on the cryptocurrency markets as a whole. He is a graduate of Rutgers University and lives in Colorado with his dogs Dorito and Pretzel.