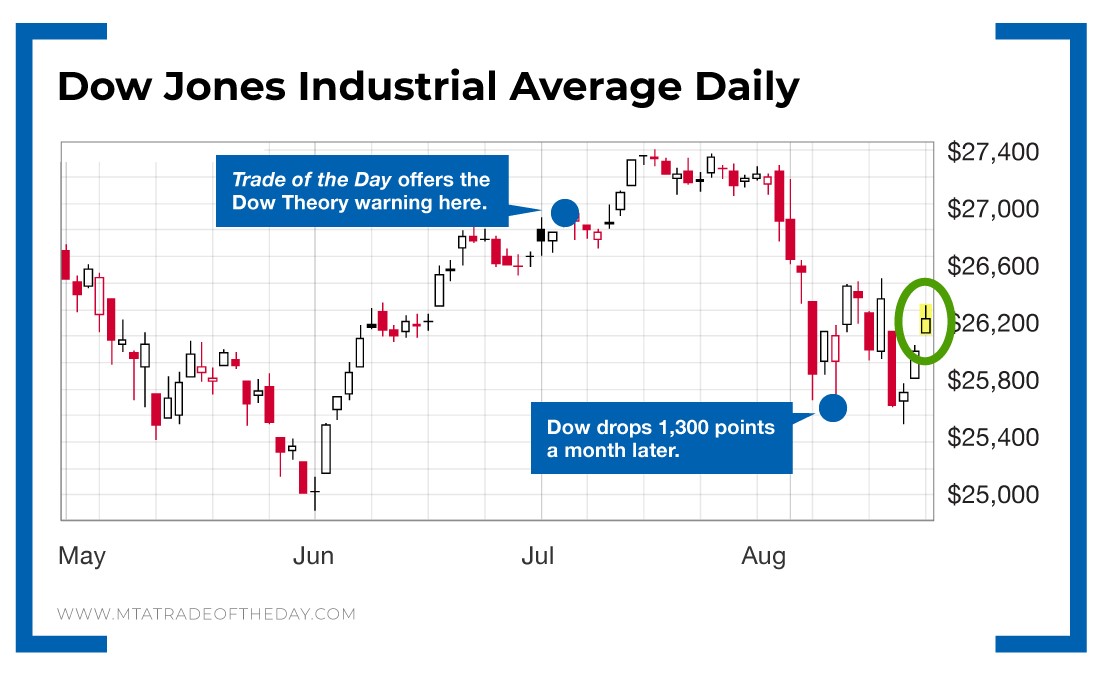

How We Predicted the Dow Jones Industrial Average Would Fall

On July 2, I posted a Trade of the Day titled “Can You Trust the Market’s Recent Run?”

The point of this article was simple…

According to the earliest known form of modern technical analysis, the major market averages were not confirming an upside trend!

As a refresher, I wrote…

Dow Theory was developed by Charles Dow, who, with Edward Jones, founded Dow Jones & Company and developed the Dow Jones Industrial Average. The two published their market theories in a series of editorials in The Wall Street Journal, which was co-founded by Dow. Dow Theory says that the market is in an upward trend if one of its averages (industrials or transports) advances above a previous important high and is followed by a similar advance in the other average.

For example, if the Dow Jones Industrial Average climbs to an intermediate high, the Dow Jones Transportation Average is expected to follow suit within a reasonable period of time. The combination of these two major indexes each confirming new highs signifies that a bull market is alive and well.

But then, I came in with the critical component of this analysis…

Both are not hitting new highs… Until the Dow Jones Transportation Average confirms the bull trend by establishing a new high of its own – the market’s bull run is in doubt. In many respects, that’s why I’ve been skeptical of this latest upside move.

Looking back today, this analysis was spot-on. For example…

- When this Trade of the Day was published, the Dow Jones Industrial Average closed the day at $26,786.68.

- By the close of trading on August 14, the Dow was at $25,479.42.

Just as predicted, the Dow dropped more than 1,300 points.

Why bring this to your attention today?

Because after the drop, the Dow is now testing – and bouncing – at a “double bottom” support level.

This could lead to instant profit opportunity…

Action Plan: Since you already saw how a study of Dow Theory predicted the recent market pullback, it’s now worth noting that a double bottom confirmation could lead to an extended bounce among the Dow transports.

To learn more and find new trading opportunities, sign up for our free Trade of the Day e-letter.

About Bryan Bottarelli

Whether it was selling the Star Wars figures he collected as a little boy for 50 times their value or using the $125 he made cutting grass to buy a Michael Jordan rookie card that he later sold for $1,500, it was always clear that Bryan Bottarelli was a born trader – possessing the unique ability to identify opportunities and leverage his investments.

Graduating with a business degree from the highly rated Indiana University Kelley School of Business, Bryan got his first job out of college trading stock options on the floor of the Chicago Board Options Exchange (CBOE). There, he was mentored by one of the country’s top floor traders during the heart of the technology boom from 1999 to 2000 – trading in the crowded and lively Apple computer pit. Executing his trades in real time, Bryan learned to identify and implement some of his most powerful trading secrets… secrets that rarely find their way outside the CBOE to be used by individual traders.

Recognizing the true value of these methods, Bryan tapped into his entrepreneurial spirit and took a risk. He walked off the CBOE floor and launched his own independent trading research service called Bottarelli Research. From February 2006 to December 2018, Bryan gave his precise trading instructions to a small, elite group – most of whom have been followers ever since.

As a “play tactician,” Bryan uses his hands-on knowledge of floor trading to shape opportunities and chart formations into elegant, powerful and profitable recommendations. And by using the same hedging techniques taught by professional floor traders, Bryan is able to deliver his readers remarkable gain opportunities while strictly limiting their total risk.

Along the way, Bryan has developed a cumulative track record that could impress even the most successful hedge fund manager.

He now spends his days moderating one of the most elite trading research forums ever created: The War Room.