Why You Should (Probably) Avoid Story Stocks

- A compelling story can be very powerful, which is why story stocks are so hard for investors to resist.

- Today, Nicholas Vardy explains why wealth builders shouldn’t trust story stocks as a “quick and easy” way to build wealth.

A compelling story is a powerful thing.

After all, a good story is concrete, convincing and easy to remember.

In the world of investing, a good story trumps rational financial analysis every time.

That’s why you always have “story stocks” no matter what the state of the market.

A story stock is never about the value of a well-established business model.

Whether it’s tulips, the “China miracle,” 3D printing, cannabis, cryptocurrency or artificial meat… investing in a story stock always offers the promise of a shortcut to quick and easy wealth.

Yet it rarely works out that way.

Yes, early investors can make a mint in story stocks. But the mom-and-pop investor rarely gets a chair by the time the music stops.

What Is a Story Stock?

Mark Twain purportedly said, “A mine is a hole in the ground with a liar at the top.”

A story stock (or commodity or cryptocurrency) is no different.

A story stock offers…

- A revolutionary, compelling and sexy theme

- A game-changing technology or “new paradigm” promising exponential growth

- A CEO anointed by the media

- A culture of overpromising and underdelivering

- Liberal use of creative accounting.

Financial analysts are always left puzzled by the market’s willingness to buy into such bunk.

I take the perspective of a market historian.

Few things are as predictable as the permanent presence of story stocks.

That’s because human psychology never changes. And as the economist John Kenneth Galbraith observed, “The financial memory is very short.”

Today’s No. 1 Story Stock

Today’s top story stock is Tesla (Nasdaq: TSLA).

Tesla bulls hail the company as the second coming. Tesla promises sleek, environmentally correct electric vehicles (EVs), solar panels and storage batteries. It combines virtue signaling with the promise of getting rich.

Tesla bears are astonished to see investors’ willingness to blithely ignore endless red flags. These include Tesla’s sky-high valuation, shoddy business practices, questionable accounting and the behavior of its gunslinging CEO.

So what’s the secret behind Tesla’s soaring share price?

Tesla is a quintessential story stock.

Tesla offers a revolutionary, compelling and sexy story.

Tesla EVs feature game-changing technology that offers exponential growth.

The media has anointed CEO Elon Musk as a brilliant visionary.

Tesla consistently overpromises and underdelivers.

And its financial statements are chock-full of questionable accounting practices.

Today, Tesla bulls are in the driver’s seat. Tesla’s share price has rocketed from a low of $178 in May to around $575 today.

Tesla bears point out that the company’s extraordinary share price run has little to do with its fundamentals.

First, the U.S. EV market has tumbled by double digits since July. Tesla experienced a 46.5% drop in California sales in the fourth quarter.

China, by far the biggest EV market, saw sales fall 45.6% in October.

Year-over-year global EV sales were down 28% in October and 26% in November.

Second, Tesla’s valuation – which has topped $100 billion – borders on absurd.

At a share price nearing $600, Tesla’s market topped the combined value of Ford and General Motors.

That’s remarkable because GM sold around 20 times as many cars as Tesla in 2019, while Ford sold more than six times as many.

Also, Tesla has never made an annual profit over its 15-year history.

And yet, ARK Invest, an investment manager, has an astonishing $6,000 price target on Tesla.

Bears point to the similarity between Musk and Elizabeth Holmes of Theranos and Adam Neumann of WeWork. The value of both companies collapsed almost overnight once their “stories” fell apart.

How I Play Story Stocks

It’s hard to remain neutral about a story stock like Tesla. Yet, as a trader, that’s precisely what you must do.

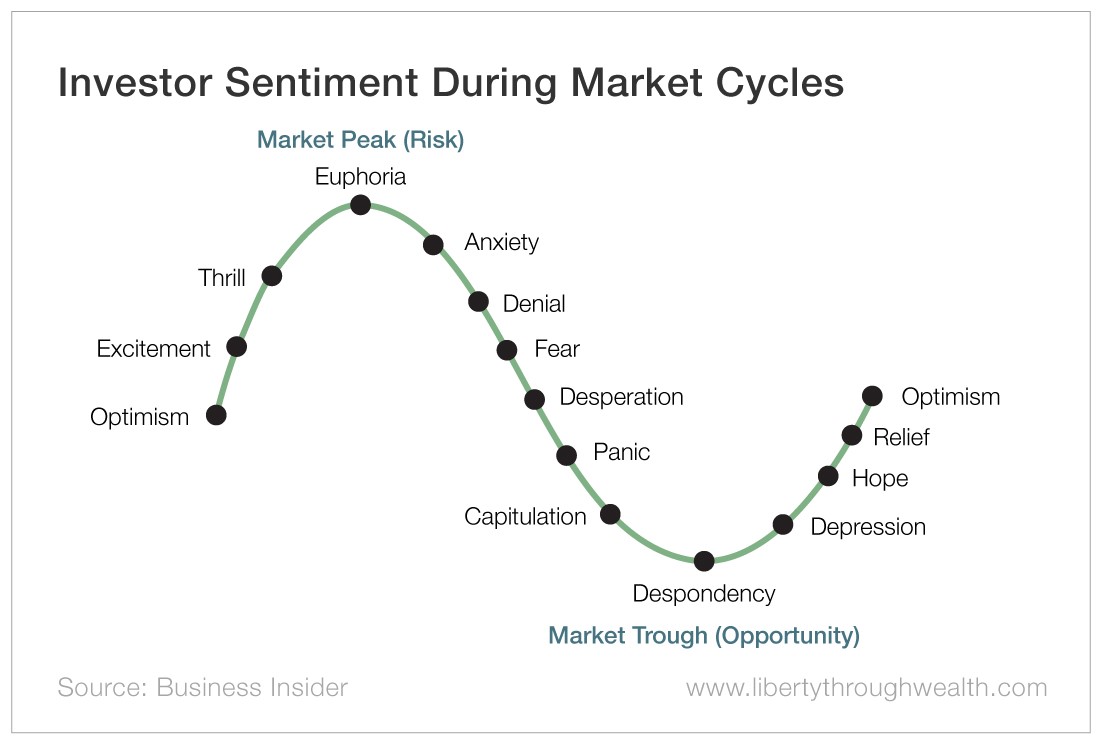

History teaches us that story stocks have a predictable arc of boom and bust. And that is reflected better in the vocabulary of market sentiment than measures of valuation.

Once you understand this recurring arc, the ideal way to profit becomes clear as day:

- Identify the story stock of today. (See the five factors I outlined above.)

- Bet on the stock on the way up.

- Bet against the stock on the way down.

This approach sounds simple. But it’s not easy. (I’ve had the best success in playing the cycle using an assortment of sophisticated options strategies.)

My best advice?

Unless you understand the arc of boom and bust in your bones, stay away from story stocks.

After all, successful investors like Warren Buffett never buy a story stock. And (probably) neither should you.

About Nicholas Vardy

An accomplished investment advisor and widely recognized expert on quantitative investing, global investing and exchange-traded funds, Nicholas has been a regular commentator on CNN International and Fox Business Network. He has also been cited in The Wall Street Journal, Financial Times, Newsweek, Fox Business News, CBS, MarketWatch, Yahoo Finance and MSN Money Central. Nicholas holds a bachelor’s and a master’s from Stanford University and a J.D. from Harvard Law School. It’s no wonder his groundbreaking content is published regularly in the free daily e-letter Liberty Through Wealth.