You Like This $12 Stock From Brazil?

You’ve surely seen the news…

Brazil is quickly emerging as the next global COVID-19 hot spot.

The country now has the second-highest number of coronavirus cases in the world after the U.S. and far worse healthcare infrastructure.

But through it all, Brazilian President Jair Bolsonaro continues to dismiss the threat of the virus, saying that quarantines and lockdowns could have a worse impact on Brazil’s economy.

It’s shaping up to be a very dangerous situation in the coming days and weeks…

So that’s why I was quite interested when one of my researchers, we’ll call him B.D., approached me and suggested that I look into a global play on sugar.

It was a $12 stock from Brazil.

Intrigued, but also slightly confused, I asked him why?

And here’s what he said…

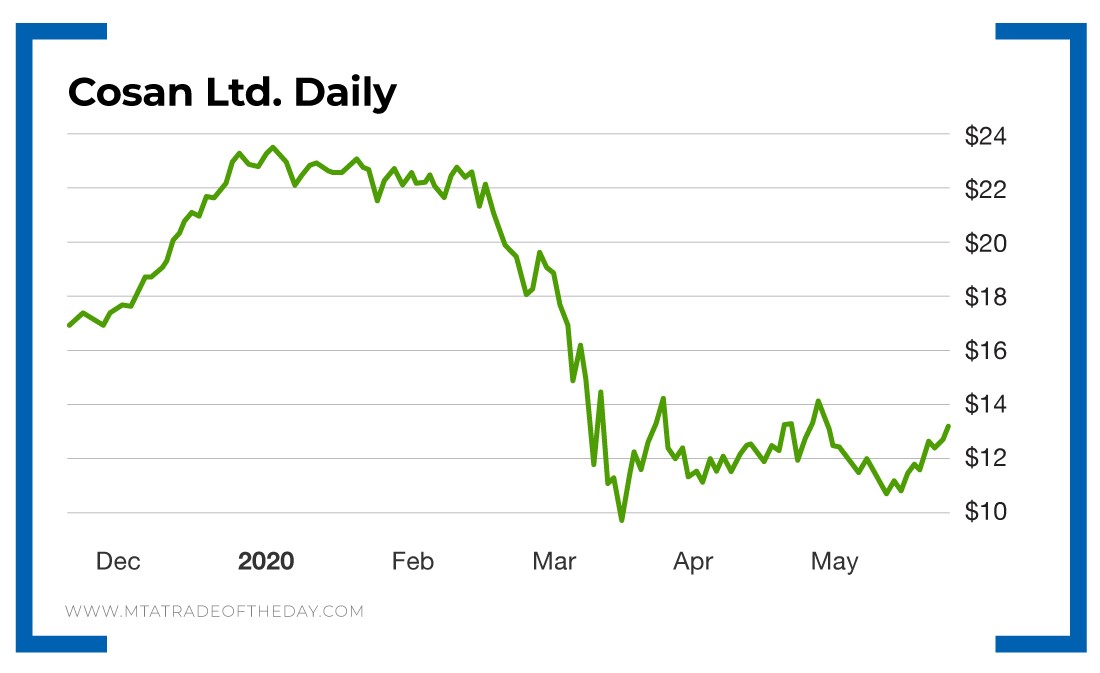

Cosan Ltd. (NYSE: CZZ) is a Brazilian producer of bioethanol, sugar and energy. At the end of 2019, it was on a tear – surprising analysts on earnings for the third year in a row and hitting a new high of $20.

But then came COVID-19, and the floor dropped out on gas prices. In less than a month, Cosan shares plummeted 50% to less than $10.

But that makes sense, right? Well, not necessarily. Dig deeper and you’ll see that unlike the biofuel companies of the U.S., Brazilian biofuel comes from sugarcane. That gives a company like Cosan the ability to pivot its production depending on the demand for each resource.

Huge demand for biofuel? Process the sugar into fuel and meet the demand.

Less demand for biofuel? Refine the sugar and sell it directly to the market.

“Not a bad idea,” I told him. To which he snapped back, “But I’m not done!”

And so he continued…

It also happens that the world ended 2019 in a sugar shortage, especially in the largest importers like Thailand and Indonesia.

In response, Brazilian sugar exports are up 50% compared with last year. And right now, Cosan is trading around $12 since the drop in March.

It has an attractive price-to-earnings (PE) ratio of 8.9. And it’s scheduled to report earnings this Thursday. The stage has been set for a nice recovery in Cosan’s share price. While I don’t see it blasting up to $20 again, we could easily see a 20% to 30% move.

Action Plan: I’ll never ignore a well-thought-out stock play argument – and this one certainly qualifies. Kudos to B.D. for his research today. Given the uncertainly Brazil is currently facing, let’s see how Cosan reacts to its upcoming earnings report – and then go from there. If it bounces, we can jump on board. If it dips, we can pick up shares for even cheaper. But until we know how Wall Street will react to its earnings, let’s keep this one on watch and be ready to pounce depending on the reaction. That’s the most logical way to approach this – given the COVID-19 escalation. But seeing how markets bounced back here in the U.S., adding Cosan at these cheap levels certainly has merit.

About Bryan Bottarelli

Whether it was selling the Star Wars figures he collected as a little boy for 50 times their value or using the $125 he made cutting grass to buy a Michael Jordan rookie card that he later sold for $1,500, it was always clear that Bryan Bottarelli was a born trader – possessing the unique ability to identify opportunities and leverage his investments.

Graduating with a business degree from the highly rated Indiana University Kelley School of Business, Bryan got his first job out of college trading stock options on the floor of the Chicago Board Options Exchange (CBOE). There, he was mentored by one of the country’s top floor traders during the heart of the technology boom from 1999 to 2000 – trading in the crowded and lively Apple computer pit. Executing his trades in real time, Bryan learned to identify and implement some of his most powerful trading secrets… secrets that rarely find their way outside the CBOE to be used by individual traders.

Recognizing the true value of these methods, Bryan tapped into his entrepreneurial spirit and took a risk. He walked off the CBOE floor and launched his own independent trading research service called Bottarelli Research. From February 2006 to December 2018, Bryan gave his precise trading instructions to a small, elite group – most of whom have been followers ever since.

As a “play tactician,” Bryan uses his hands-on knowledge of floor trading to shape opportunities and chart formations into elegant, powerful and profitable recommendations. And by using the same hedging techniques taught by professional floor traders, Bryan is able to deliver his readers remarkable gain opportunities while strictly limiting their total risk.

Along the way, Bryan has developed a cumulative track record that could impress even the most successful hedge fund manager.

He now spends his days moderating one of the most elite trading research forums ever created: The War Room.