You’ll Never Guess What’s Sold Out Across America Right Now!

As I’m sure you know, the race for a vaccine is on… with each second the markets are open. The direction of the market depends on whether the vaccine news flow is positive or negative.

You saw that positive impact on Monday, when the Dow soared 1,000 points on the promise of Moderna’s (Nasdaq: MRNA) vaccine.

You also saw the negative impact yesterday afternoon, when doubt was planted about the true validity of Moderna’s vaccine effectiveness – and the markets got hit with a sharp and sudden reversal.

Clearly, the direction of the markets now hinges on the vaccine news – which is a second-by-second coin flip.

So this means you must remain nimble and balanced as you navigate through a market that’s entirely driven by the vaccine news cycle.

But surprisingly enough, today’s Trade of the Day has nothing to do with a vaccine.

You may think that it comes totally out of left field… and you’d be right.

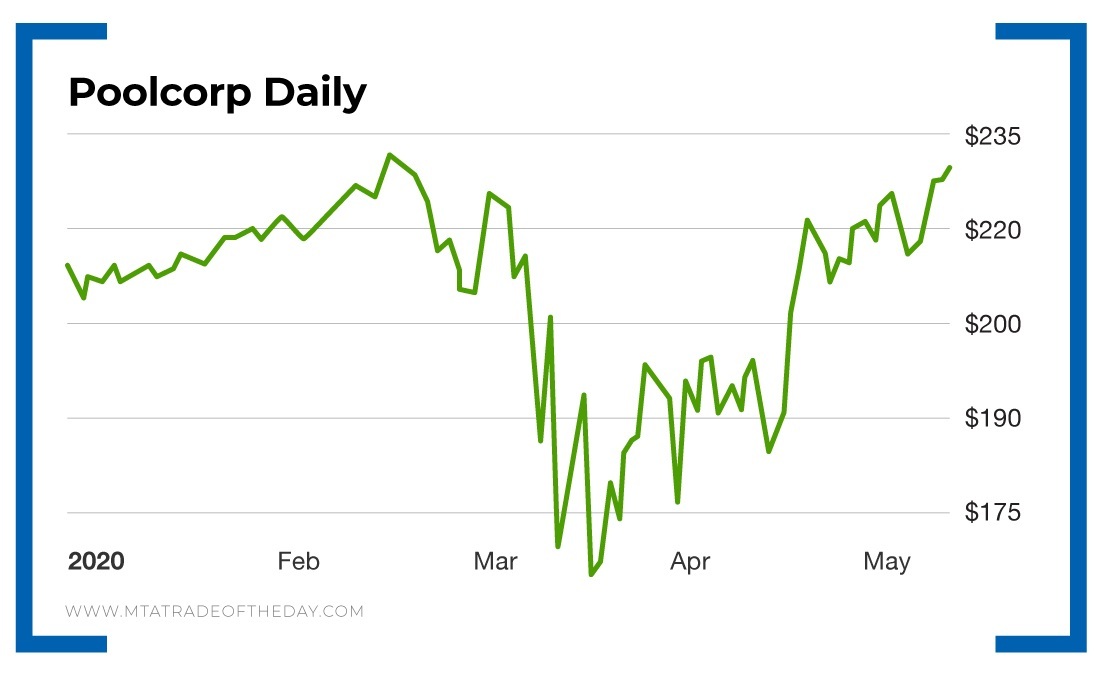

You see, I’m going to explain why Poolcorp (Nasdaq: POOL) has grabbed my attention…

I caught up with a college friend last week. She’s been trying to buy a backyard swimming pool for her kids this summer – and it’s been nearly impossible.

In fact, she resorted to a bidding war on eBay because pools are sold out everywhere else.

If you think about it, the logic makes total sense…

The looming threat of entertaining your kids all summer long means products that provide backyard amusement and recreation (such as swimming pools and trampolines) are back in high demand.

That’s where Poolcorp comes into play…

Poolcorp is a global pure play on swimming pools. It distributes swimming pool supplies, equipment and related leisure products in North America, South America, Europe and Australia.

The company also offers maintenance and repair products, like chemicals, supplies, accessories, and more for both in-ground and above-ground pools.

If you’ve ever had a pool – or know someone who has – you know that they’re expensive to maintain – and Poolcorp stands to capitalize on this consistent revenue stream for the lifetime of that backyard pool.

Talk about a reoccurring revenue model!

Not only that, but Poolcorp also offers construction and remodeling services for existing pools, as well as irrigation and landscape products. This even includes professional lawn care equipment and supplies. Add it all up, and Poolcorp is a winner that I really like, with or without a vaccine.

Action Plan: Poolcorp is an expensive stock, which means that the options carry a big premium. However, this might make for a nice stock play – or even a put sell.

Now, I admit – unemployment is at an all-time high, with 33 million Americans out of work over the last two months. But that hasn’t stopped Poolcorp. On April 24, the company gained 7% after reporting adjusted earnings of $0.71 per share, which beat the consensus estimate of $0.65 and increased 20.3% from a year ago. Quarterly net revenues totaled $677.3 million, which also surpassed the consensus mark of $636.5 million and increased 13.4% year over year. So as we head into summer, I like the idea of dipping a toe into the water on shares of Poolcorp (yes, pun intended).

So what are you waiting for? Dip a toe into the water, and join me in The War Room today!

P.S. Our biggest performance guarantee EVER – coming soon…

Right now, behind the scenes, we’re preparing toofficially launch one of the biggest performance guarantees we’ve ever offered. I can’t say anything more right now – except that you’ve never seen anything quite like this. So be sure to keep your eyes open because this is truly unprecedented. More to come…

About Bryan Bottarelli

Whether it was selling the Star Wars figures he collected as a little boy for 50 times their value or using the $125 he made cutting grass to buy a Michael Jordan rookie card that he later sold for $1,500, it was always clear that Bryan Bottarelli was a born trader – possessing the unique ability to identify opportunities and leverage his investments.

Graduating with a business degree from the highly rated Indiana University Kelley School of Business, Bryan got his first job out of college trading stock options on the floor of the Chicago Board Options Exchange (CBOE). There, he was mentored by one of the country’s top floor traders during the heart of the technology boom from 1999 to 2000 – trading in the crowded and lively Apple computer pit. Executing his trades in real time, Bryan learned to identify and implement some of his most powerful trading secrets… secrets that rarely find their way outside the CBOE to be used by individual traders.

Recognizing the true value of these methods, Bryan tapped into his entrepreneurial spirit and took a risk. He walked off the CBOE floor and launched his own independent trading research service called Bottarelli Research. From February 2006 to December 2018, Bryan gave his precise trading instructions to a small, elite group – most of whom have been followers ever since.

As a “play tactician,” Bryan uses his hands-on knowledge of floor trading to shape opportunities and chart formations into elegant, powerful and profitable recommendations. And by using the same hedging techniques taught by professional floor traders, Bryan is able to deliver his readers remarkable gain opportunities while strictly limiting their total risk.

Along the way, Bryan has developed a cumulative track record that could impress even the most successful hedge fund manager.

He now spends his days moderating one of the most elite trading research forums ever created: The War Room.