How to Energize Your Portfolio in 2020

“Drill, baby, drill!”

John McCain may have lost the 2008 election, but his campaign mantra came true.

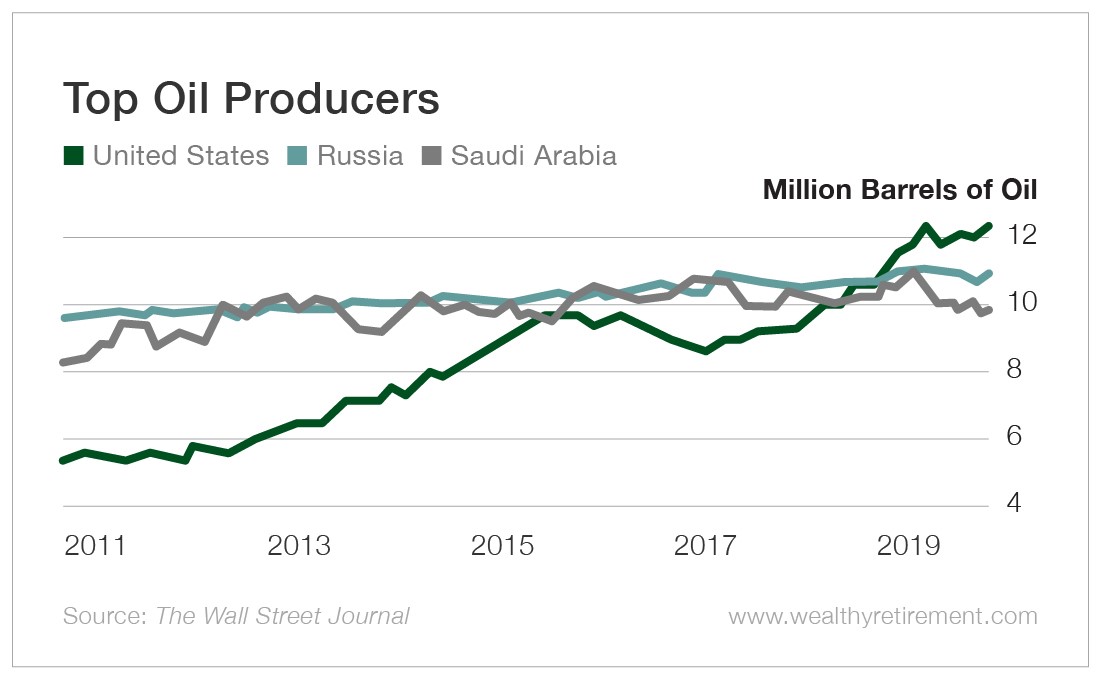

The past decade has been revolutionary for American energy. Thanks to hydraulic fracturing, or “fracking,” the U.S. surpassed Russia and Saudi Arabia to become the world’s largest oil producer.

In 2020, the U.S. is expected to be a net exporter of energy for the first time since the early 1950s.

This is an “only in America” kind of story. U.S. companies, using technology developed here, leveraged the free market system to radically change America’s energy profile.

It’s hard to overstate how profound this change is – especially for those who remember the “energy shocks” of the 1970s.

Back then, we were at the mercy of OPEC. Now America holds a much stronger hand in the world’s largest – and arguably most important – industry.

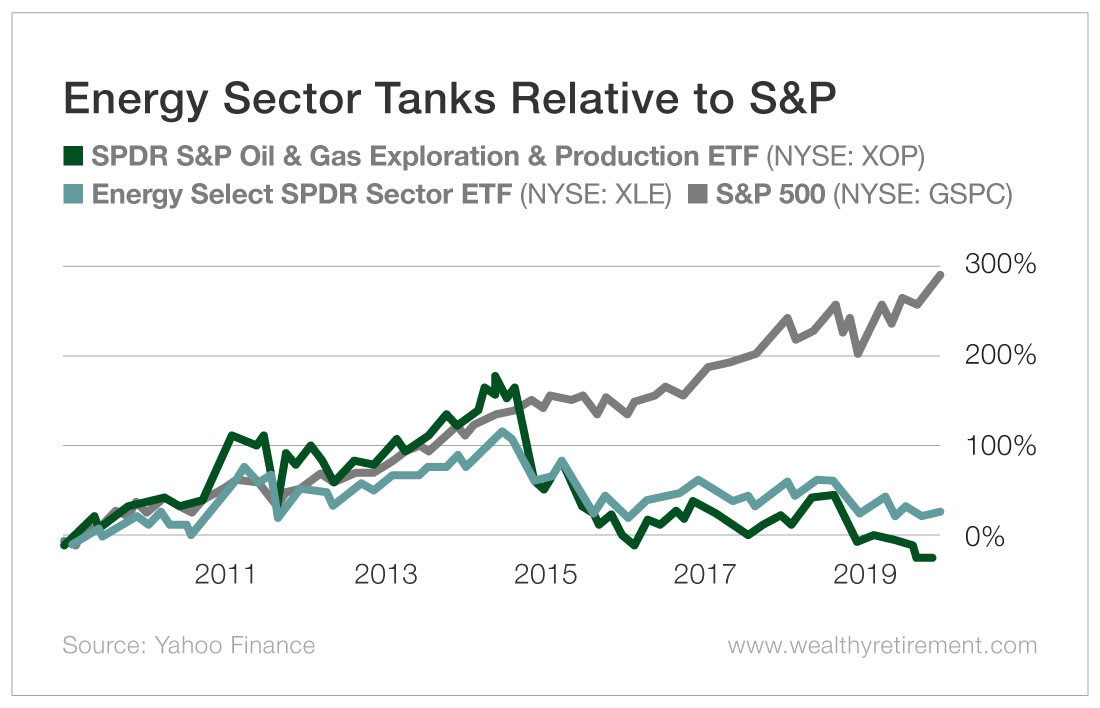

But America’s energy revolution has not benefited energy investors – at least not yet. The sector has been a dismal performer in the past decade relative to the S&P 500.

There is a simple reason for this: The increased supply of American oil has overwhelmed demand during a decade of sluggish global growth and pushes to use alternative sources of energy.

But energy stocks look poised for a comeback in the coming decade…

Factors Fueling an Energy Sector Comeback

The sector has jumped in the days since the U.S. military killed Qasem Soleimani, a top Iranian general. Soleimani was head of the Quds Force, which the Trump administration designated a foreign terrorist organization in April.

Investors bid up the price of oil in reaction. Soleimani’s killing raises the threat of a wider war in the region, and Iran’s supreme leader, Ayatollah Ali Khamenei, and other senior Iranian officials have vowed to retaliate.

Heightened tensions in the Gulf are good for oil prices – even if they’re bad for humanity.

But my bullish view on energy is not based on geopolitics. Notably, crude prices retreated sharply to start this week even as tensions between the U.S. and Iran stayed hot. Instead, I’m focused on three key drivers:

- Supply and demand. The global economy is poised to rebound in 2020, which will drive increased demand for oil.And while many countries are moving to alternative sources of energy – solar, wind and nuclear power – fossil fuels still account for about 80% of global energy.Meanwhile, oil supply should fall in 2020. OPEC members pledged to make production cuts in December, and the U.S. rig count fell about 25% in 2019 versus 2018, according to Baker Hughes.

- Monetary policy. The Fed is fighting the last war. Because central bankers are so concerned about deflation, they will let inflation run “hot” before raising rates.An easier Fed means weakness in the dollar, which will result in higher spot prices for commodities like oil.

- The great rotation. A decade of outsized gains for tech stocks, utilities and healthcare has investors searching for value in other areas.Basic mean reversion suggests we’ll see a reversal of the past decade’s trends, in which growth sectors dramatically outperformed cyclical sectors like energy. The biblical phrase “So the last shall be first, and the first last” comes to mind…

The forward price-to-earnings (P/E) ratio of the energy sector was 17 at the end of 2019, according to Yardeni Research. That’s slightly less than the S&P 500’s overall ratio, suggesting energy could be trading at a value.

Meanwhile, the sector’s dividend yield is 5%, more than double the S&P 500’s 2%.

Plays for Investors Big and Small

Notably, investing legend Peter Lynch is also bullish on the energy sector.

“You wouldn’t know it from the stocks, but oil is 25% higher than a year ago,” Lynch recently told Barron’s. “I’m buying companies that I don’t think will go bankrupt.”

Lynch didn’t name names, but he said U.S. small cap oil and natural gas stocks could be “three-baggers” in the coming decade.

One way to play this trend is via the SPDR S&P Oil & Gas Exploration & Production ETF (NYSE: XOP).

While the more popular Energy Select SPDR (NYSE: XLE) is heavily weighted in global players like ExxonMobil (NYSE: XOM), the SPDR S&P Oil & Gas Exploration & Production ETF invests in domestic producers like Marathon Petroleum (NYSE: MPC) and Murphy Oil (NYSE: MUR).

Another top holding, Apache Corp. (NYSE: APA), jumped 25% on Tuesday after an upgrade from J.P. Morgan.

The SPDR S&P Oil & Gas ETF is a way to bet on a continuation of the U.S. shale revolution and the potential for a global economic rebound in 2020.

A wider war in the Middle East will also boost the energy sector, but it’s far too unpredictable a situation to make investing decisions around – and I’m certainly not rooting for it.

I much prefer to stick to the macroeconomic fundamentals, which are lining up in energy’s favor.

About Aaron Task

Aaron is an expert writer and researcher who formerly served as editor-in-chief at Yahoo Finance, digital editor of Fortune, and executive editor and San Francisco bureau chief of TheStreet. You may have also seen him as a guest on CNBC, CBS This Morning, Fox Business, ABC News and other outlets.

A prolific writer and commentator, Aaron is the former host of Yahoo Finance’s video program The Daily Ticker. He has also hosted podcasts for Fortune (Fortune Unfiltered) and TheStreet (The Real Story). His latest on-air passion project, Seeking Alpha’s highly rated Alpha Trader podcast, features top Wall Street experts dissecting the market’s latest news and previewing significant upcoming events. He also regularly provides analysis for the free e-letter Wealthy Retirement, which we will be republishing here on Investment U.