Here’s Why You Shouldn’t Fear the Election Outcome

If you’re an investor and you’re worried about the tech stock sell-off or the upcoming election, you shouldn’t be!

On Tuesday I wrote about why investors shouldn’t fear a sell-off in tech stocks if it’s orderly and gradual.

Today, we’ll go one step further and take a look at the election.

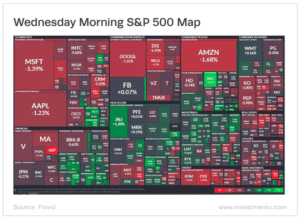

But first, look at the market visualization from late-morning Wednesday thanks to our friends at Finviz.

Broad market indexes like the S&P 500 and especially the tech-heavy Nasdaq composite were down, as shown by the influx of red in the graphic. But as you can see, it was more of a redistribution of capital (often called a sector rotation) than a marketwide sell-off.

And that’s a good thing.

Investors have been treating mega-tech stocks as “defensive” stocks, and running to them in times of anxiety (during much of 2020). When they sell these stocks to move money elsewhere, it’s a positive sign of growing optimism about the market and the economy.

So while tech stocks were down (red), other sectors, including healthcare, industrials and consumer cyclicals – with the exception of Amazon (Nasdaq: AMZN) – were up (green).

And check out Nike (NYSE: NKE), up almost 9% in late-morning trading Wednesday. The apparel and footwear maker reported better-than-expected earnings Wednesday morning, which analysts say represents “pent-up” sales.

That’s also good news – the all-powerful American consumer is back!

Election Worries Complicate Things

But I digress.

Today I mainly want to discuss why investors shouldn’t worry about the upcoming election.

But let me be clear: I mean this solely from a stock market and investor perspective. I’ll leave it to the politicos to write about other issues.

The conventional wisdom has it that Republicans are friendlier to the business sector than Democrats. And there’s much truth to that. Republicans like to cut corporate and individual taxes, as well as red tape. President Trump pushed through a historic tax cut early in his administration, and President George W. Bush did the same when he was in office.

Tax cuts on individuals are good for consumer spending. Tax cuts on companies are good for earnings, which drive stock prices in the long run.

So it wouldn’t be surprising that we investors should be tempted to link economic growth and stock market returns with the political party in the White House.

But the data doesn’t support that link… at all.

According to an insightful September 21 report by Gavekal Research, equities performed about the same at an annualized rate under former President Obama as under President Trump: about 12.4% annualized for the Democrat and 13.9% for Trump, as measured by the S&P 500.

Yes, slightly better under Trump, but not by much.

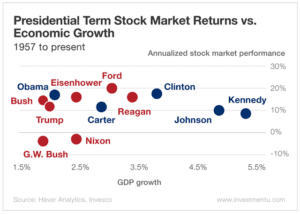

And here’s a graphic I love, from investment management firm Invesco. (This one shows Obama’s record on equities as slightly better than Trump’s – it’s from June 30, and the S&P 500 is up about 6% since then, which has improved Trump’s numbers.)

As you can see, two of the worst market and economic performances came during Republican administrations, and several of the best under Democrats. But generally, it’s mixed.

Why?

Don’t Put Politics Into Your Portfolio

Well, for all their campaign trail bluster, presidents don’t tend to radically overhaul the economy. Sure, tax cuts and deregulation have an impact, but it’s marginal. Other things matter more, like monetary policy, the business cycle and recessions, which can be caused by events almost completely separate from the political sphere, such as a housing or stock bubble bursting.

In our own world, imagine what the economy and the market might do once a coronavirus vaccine is approved and rolled out. Yet neither Trump nor Biden has little to do with that process and timing, despite what the media might say.

So make your investment decisions based on fundamentals and market trends, and don’t try to analyze the election.

To be fair, markets do hate uncertainty. And some major market players are saying the biggest election-related risk to the market will be a contested election with no clear winner.

And this year, that’s a very real possibility.

The VIX, a measure of market volatility and investor anxiety, tends to rise significantly in the month preceding a presidential election and then calms down when the dust has settled.

Once we have a confirmed winner (both for the White House and the Senate), other things will matter more than who’s sitting in the Oval Office.

Do you have other concerns about how the upcoming election will impact the stock market? Any questions about investing and trading in general? We’re here for you. Just click here to send in any questions you have and I’ll address them in an upcoming issue. I’m looking forward to hearing from you!

Be sure to check your email tomorrow for more up-to-the-minute insights from Investment U’s top market experts.

Enjoy your day and stay safe,

Matt

About Matt Benjamin

Matt has worked as an editorial consultant to the International Monetary Fund, the World Bank, the Economist Intelligence Unit and other global macro-institutions. He wrote about markets and economics for U.S. News & World Report, Bloomberg News and Investor’s Business Daily, among other publications. He also worked for several years as head of political economy for a Financial Times-owned macroeconomic consulting firm, advising hedge funds around the world. Matt’s claim to fame is that he’s interviewed two U.S. presidents and has spoken with five Federal Reserve Chairs from Paul Volcker through Jerome Powell. Matt also served as The Oxford Club’s Editorial Director for two years.