M1 Finance Review: A Robo-Powered Investment Tool With Lots of Benefits

There are lots of great apps out there for traders. But in this M1 Finance review, we’ll show you why this online brokerage is ideal not just for traders… but for investors as well.

Where the name M1 Finance comes from is a bit of a mystery. So we’re not saying it comes from the M1 carbine – the standard firearm in the U.S. military for decades – but the two do share some similarities. For instance…

- The M1 carbine was lightweight and practical. M1 Finance fits anywhere your smartphone does and offers the chance to easily invest from anywhere.

- The M1 carbine was built because the alternatives were weighty and unreliable. M1 Finance was born from a frustration with the status quo in the fintech industry.

- As the M1 carbine became ubiquitous, its capabilities became more robust. Its sights were updated to make it more accurate. Larger magazines were made to increase its capacity. And eventually, a fully automatic version was released. M1 Finance has integrated digital banking into its investment capabilities. There are also auto-invest choices. And brokerage fees were eliminated not long after the company’s inception.

Pithy analogies aside, M1 Finance deserves investors’ attention. This fast-growing company is regularly developing new tools that are exceptionally useful for long-term investors. It offers a bevy of research tools and strategies.

There are several expert-developed pre-made portfolios available. Or investors can choose to go it alone. To put it simply, M1 Finance is proving a laudable force in the popular automated segment… and a promising powerhouse to help investors achieve financial freedom. And this M1 Finance review is just getting started…

M1 Finance’s Strengths

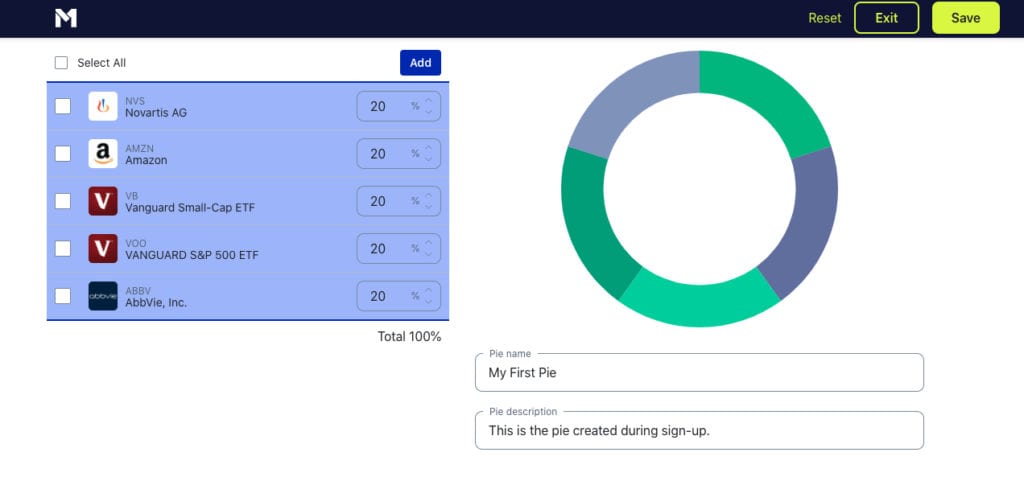

For a new investor, the hardest part can be knowing where to start. M1 removes analysis paralysis from the equation. After setting up an account, new users are asked to set up their “pie.” This is essentially the makeup of their portfolio.

As M1 describes it, what you choose as your pie are the building blocks designed to organize and manage your portfolio. You’re asked to pick at least three investments of interest. You can choose from popular stocks, popular funds, go with expert-created “pies” or simply pick the investments you’d like your funds to go into. And once they’re set, you can leave them be or infinitely revise them.

Once you’ve got the pieces of your pie established, you choose how much weight each choice holds. This comes in particularl handy thanks to the advent of fractional shares. So if you’ve got a couple of Vanguard funds, a couple of biotech firms and a couple of popular stocks like Amazon (Nasdaq: AMZN) that you’d like to invest in, you get to decide the percentage of your funds that gets directed to each of them.

In this case, every dollar directed to be invested will be evenly split amongst each security. And the percentage can be re-jiggered at any time.

But if you’d prefer not to pick and choose for yourself, that makes it even easier…

You can also choose to leave it up to the experts. Want to choose a portfolio for retirement? They’ve got you. Do you have a penchant for investing in companies that are socially and environmentally responsible? There’s a pre-made portfolio for you. There also are income-earning portfolios based on companies with strong dividend yields. If a mix of stocks and bonds is up your alley, there’s a portfolio for that too. And the list goes on…

The Bonus Tools

For investors who have done some preliminary research, M1 has powerful resources available. If you know you’re looking for investment opportunities with a strong P/E ratio, you can sort by that statistic. If you’re looking for companies operating with a specific market cap, you can sort by that too. Again, M1 makes it incredibly easy to develop a well-performing portfolio based on the details you choose.

Once you establish your portfolio (sorry, I mean pie), all you have to do is set the weight of each investment and the auto-invest option can take care of the rest. Or you can put funds into your M1 account as you see fit and it’ll take care of it.

For instance, if you have a mix of ten stocks and funds in your portfolio and set each with a 10% weight, every time you deposit $100, each gets $10. But again, if you don’t want to pick and choose yourself, you don’t have to. You can pick a single expert portfolio and let M1 have at it.

For investors who want to make their money work a little harder, M1 also offers margin accounts. There is a standard 3.5% interest rate on margin loans for standard M1 users. And for those who upgrade to M1 Plus ($125 per year), they can access 2% margin loans.

Reviewing M1 Plus

In addition to being a brokerage firm, M1 has also gotten into the banking business. But as we mentioned, it does come with a fee. It’s up to you if the fee is worth it.

M1 Plus members are given access to a 1% annual percentage yield (APY) checking account – which is way above the national average. If you keep a substantial amount of money in your account, it will quickly pay for itself. But if you only keep a few thousand dollars in your account, it may not make as much sense.

In addition to the checking account, M1 Plus customers are also given a debit card that can earn 1% cash back on purchases. They also have access to increased trading control timelines and additional automation features that keep your money working for you.

M1 Finance Review: The Bottom Line

If you’re serious about investing, but not quite sure where M1 Finance should be on your shortlist. This relatively new kid on the brokerage block is giving other robo-investing services a run for their money. In this M1 Finance review, we found it to be one of the most robust options out there.

Case in point, M1 doubled its assets in just a six-month period in 2020. And it hit the $2 billion mark faster than any of its fintech peers, with fewer rounds of funding than the others. Investors young and old are flocking to M1 and for good reason. It takes the thinking out of investing and puts your money to work for you. And it offers many traditional brokerage features as well.

There is a slight learning curve with this brokerage. It took us a little while to figure out how to manage the auto-investing options. And adjusting portfolios took a little bit of time to get used to. Beyond that, the only thing M1 is lacking at this point compared with some of its peers is options trading. But based on the speed M1 has been rolling out new services, this could be in the not-too-distant future.

To learn more about investing platforms and opportunities, consider signing up for our free e-letter below. It’s packed with useful insight from investing experts.

Read Next: Betterment Review: A Perfect App for Hands-Off Investors

About Matthew Makowski

Matthew Makowski is a senior research analyst and writer at Investment U. He has been studying and writing about the markets for 20 years. Equally comfortable identifying value stocks as he is discounts in the crypto markets, Matthew began mining Bitcoin in 2011 and has since honed his focus on the cryptocurrency markets as a whole. He is a graduate of Rutgers University and lives in Colorado with his dogs Dorito and Pretzel.