Markets Anticipate a Wild Election Month

Financial markets are growing increasingly concerned about the election… but for different reasons than you might think.

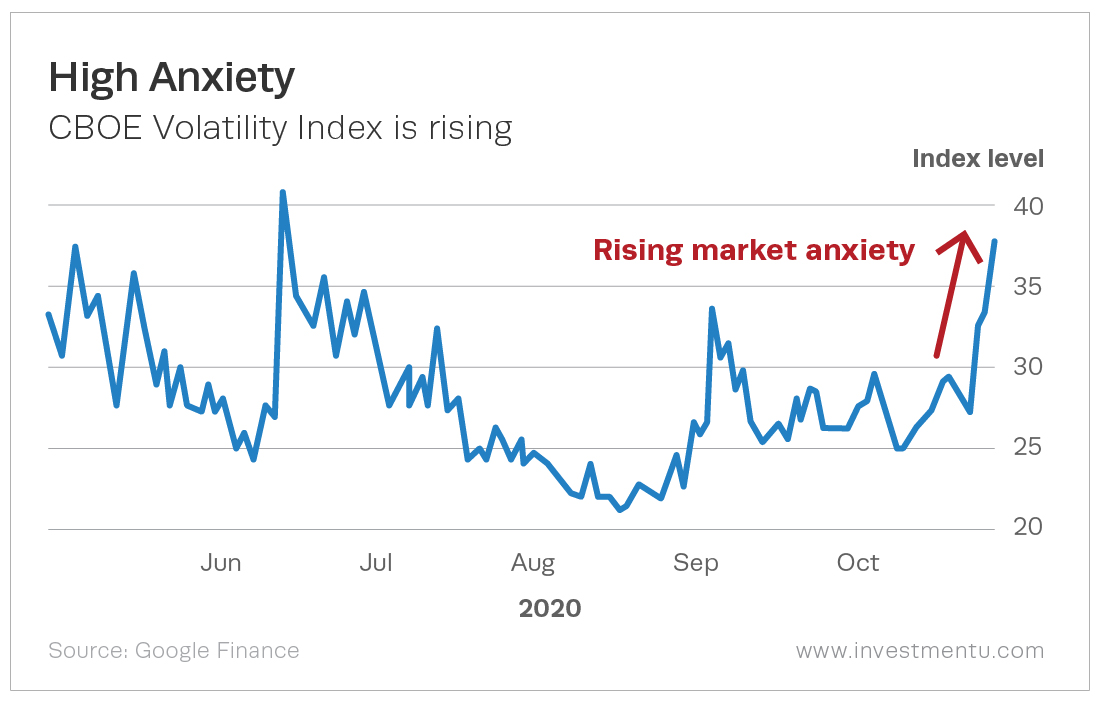

You can see this rising concern in the recent spike in the Volatility Index, known in the markets as the VIX. It’s a measure of market anxiety about the possibility of something unexpected happening in the future.

Essentially, when investors become uncertain about the future, the VIX rises.

Take a look at this chart, which shows the movement of the VIX in recent months…

The VIX has been rising since early October, and on Wednesday it pushed above 37, its highest level since early June.

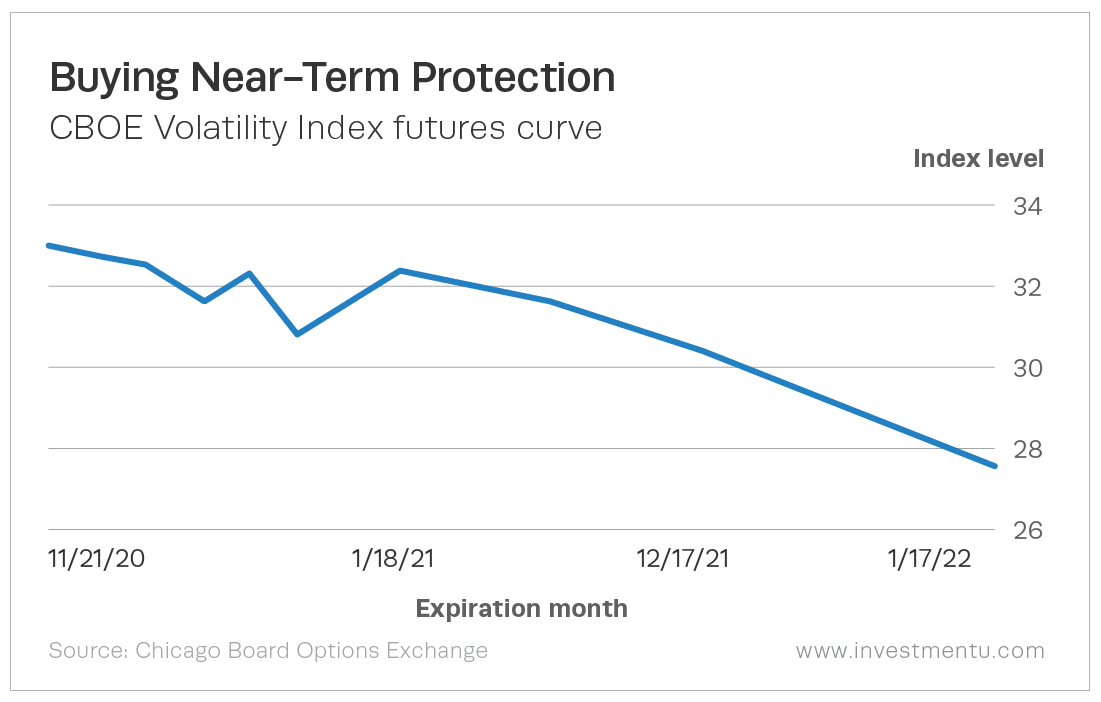

Yet this rising investor anxiety is not about which candidate will win the election or what policies his administration will implement. We can infer that from the VIX futures curve.

Investors can buy options on the VIX to insure their portfolios. If the market crashes, the value of their VIX options will rise and offset some of their stock losses. So the prices of VIX options contracts (by month) can tell us roughly which time period worries investors the most.

The current VIX futures curve shows that insurance is most expensive for November and falls in price in the months following it. See for yourself…

Typically, the VIX futures curve slopes upward from left to right, as insuring against volatility further out in the future is more expensive. That’s natural.

But right now, investors are paying more for near-term insurance–specifically for around the election.

The way to read this is that markets are not all that worried about erratic Trump trade policies or higher taxes under Biden in 2021. Instead, they’re worried about the potential for a delayed or inconclusive election result in November.

I spoke to Bryan Bottarelli, a former CBOE trader and co-founder of Monument Traders Alliance, about this. “Never in my lifetime has the market been faced with this sort of insane election volatility,” he told me. “Stock markets hate uncertainty, and this is by far the most uncertain election we’ve faced in our lifetimes.”

According to JPMorgan Chase, markets are pricing in the possibility of daily moves in the stock market in the days and weeks surrounding Election Day that are three to four times the daily average market move.

And it’s not just stocks that are expected to fluctuate wildly in November.

Options pricing in recent weeks shows that markets are bracing for dramatic moves next month in the prices of oil and gold, in exchange and interest rates, and in other financial instruments.

Because the potential for a contested election seems relatively high at the moment, pricing any of those things could be very difficult and uncertain in early November. Thus, the high cost of insuring those assets that month.

We’re In for a Wild Ride

Right now, the polls have Biden up by an average margin of 50.6% to 43.4%, according to Real Clear Politics. And according to FiveThirtyEight, which simulates thousands of scenarios that consider different results in all the states, Biden has an 88% chance of winning the electoral vote tally, and thus the White House.

But investors and markets remember election night in 2016 all too well, when polls and election analysts got it very wrong. And polls are only as good as the people who answer them. There is a very real possibility that not everyone surveyed by pollsters is giving a candid answer.

As we investors know, people are more honest when they back their opinions with their money. Therefore, I like to look at PredictIt, a website where you can bet money on the election outcome. The PredictIt market sees Trump’s chances of reelection much higher, at about 421%, and Biden’s chances of winning just above 60%.

Given what happened four years ago, I think PredictIt might be a better bet. And what the VIX is doing right now supports that conclusion.

So according to the smart money, election night and the following day are likely to be a wild ride.

And if you too are experiencing anxiety about the impact of this unpredictable election on your portfolio -– or are just curious about how to profit from gyrating markets -– you need to know about what Bryan Bottarelli has planned.

For the first time ever, Bryan is hosting a Free market livestream the day after the election. He’ll show you exactly how to respond to the election results, minute by minute and second by second, whether we have an election winner or not. If you’re concerned about how the election fallout could impact the markets and your portfolio, you can’t afford to miss this event.

Join the LIVE Election Survival Summit on: Wednesday, November. 4, at 1 p.m. ET.

Be sure to sign up for Investment U’s free e-letter for more up-to-the-minute insights from Investment U’s top market experts.

Enjoy your day and stay safe,

Matt

About Matt Benjamin

Matt has worked as an editorial consultant to the International Monetary Fund, the World Bank, the Economist Intelligence Unit and other global macro-institutions. He wrote about markets and economics for U.S. News & World Report, Bloomberg News and Investor’s Business Daily, among other publications. He also worked for several years as head of political economy for a Financial Times-owned macroeconomic consulting firm, advising hedge funds around the world. Matt’s claim to fame is that he’s interviewed two U.S. presidents and has spoken with five Federal Reserve Chairs from Paul Volcker through Jerome Powell. Matt also served as The Oxford Club’s Editorial Director for two years.