It’s Time to Change Your Gold Investing Strategy

Gold prices are surging.

The safe haven of choice for the world’s big-money investors easily surged over the $1,600 mark this week. It’s a price we haven’t seen since 2013.

Palladium is hot, too.

The rare but highly used industrial metal is scoring one record price after the other.

The commentary on this bull run is fun to watch. Now that gold is reaching fresh heights and has added an extra hundred bucks to its price, headline writers are starting to pay attention.

They’re blaming Germany’s slowdown, Japan’s shrinking economy and, of course, the spread of the coronavirus.

In the minds of folks reading those irresponsible headlines, Apple’s sour note on Monday is the reason gold just hit $1,600.

The press hardly mentions the fact that gold has been on a bull run since September of 2018… the very same time the Federal Reserve told us that its “accommodative” stance was over.

Ha.

Mr. Market saw right through this buffoonery.

You’re Right

Since gold began its beeline higher, the Fed has injected hundreds of billions of dollars into the banking sector. It’s a desperate attempt to keep banks lending and make sure artificially low interest rates remain, well, artificially low.

But we didn’t pick up the pen this morning to tell you to buy gold.

Its worth is a given.

We’re writing you with a warning.

If you pay attention only to the mainstream press and if you religiously follow conventional Wall Street “thinking,” you will get burned.

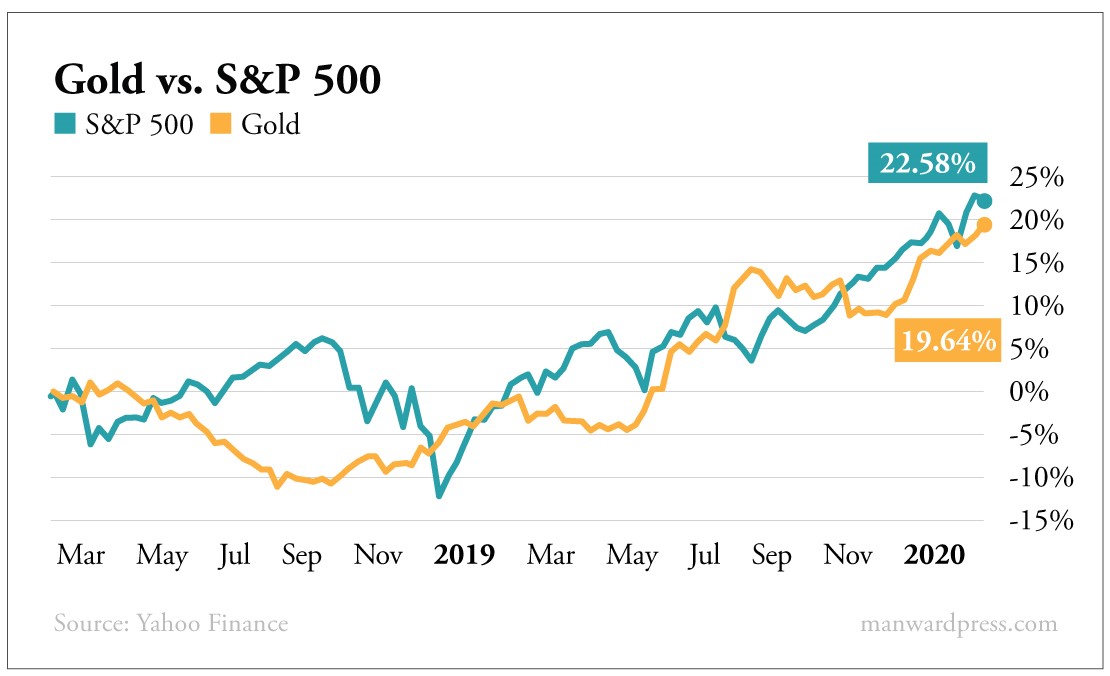

You’ll not only miss out on an asset class that’s outperforming the S&P 500 so far this year but also miss out on an asset that has kept near-perfect pace with the market over the last two years.

It’s more proof of a theme we’ve penned a lot about in recent weeks.

If you stick with what you’re “supposed” to do… you’re in big trouble.

In other words, if you think you should be earning more from your investments…

If you think you’ve been misled…

If you feel like others are doing better…

Or if you simply have a hunch that there’s a smarter way of doing things…

You’re right.

Updating the History Books

The conventional thinking on gold is outdated. Break out a business school textbook or get out one of our old manuals from the advisory business and you’ll see the same mantra over and over.

Gold, the old wisdom says, should be a mere sliver of your portfolio.

They’ll also tell you that gold and stocks are uncorrelated. And they’ll convince you that gold does you good only when stocks are falling… that it’s nothing but a drag in a rip-roarin’ bull market.

It’s bunk.

Of course, the folks behind those ideas aren’t liars or cheats. They’re very smart folks with good intentions.

And those ideas were indeed true when they were written.

But they’re not true today.

These days, the markets move according to Bernie Sanders’ latest poll numbers… the latest stimulus plans from China… and, of course, the latest interventions by the Federal Reserve.

Those ideas weren’t nearly as prominent 50 years ago when the “modern” investing canon was written.

The folks behind those works would be stunned by that chart above. They’d never believe gold was stretching to fresh highs at the same time stocks were reaching milestones of their own.

That’s why it’s critical that, dare we continue to repeat ourself, you think for yourself.

Does it make sense to invest the same way you did 50 years ago? Have things changed?

You know the answer.

If you’re not getting what you want… change your strategy.

About Andy Snyder

Andy Snyder is the founder of Manward Press. An American author, investor and serial entrepreneur, Andy cut his teeth at an esteemed financial firm with nearly $100 billion in assets under management. In the years that have followed, he’s become sought after for his outspoken market commentary.

Andy and his ideas have been featured on Fox News, on countless radio stations, and in numerous print and online outlets. He’s been a keynote speaker and panelist at events all over the world – from four-star ballrooms to Capitol hearing rooms – and has rubbed shoulders with lawmakers, lobbyists and Washington insiders. He’s had lunch with John McCain… fished with America’s largest landowner… and even appeared on the Christmas card of one of Hollywood’s top producers.

Today, Andy’s dissident thoughts on life, Liberty and investing can be found in his popular e-letter, Manward Financial Digest, as well as in the pages of Manward Letter. He also is at the helms of the award-winning VIP Trading Research Services Alpha Money Flow and Venture Fortunes. Andy resides on 40 bucolic acres in rural Pennsylvania with his wife, children and a steadily growing flock of sheep.