Value vs. Growth Stocks: Which Is Right for You?

Buy low, sell high. That’s every investor’s goal. And there are lot of ways to look for an investment with an upward trajectory. But below we’re going to go over two strategies that sound similar but have some key differences.

In this round of head-to-head investment strategies, we’re breaking down value vs. growth stocks.

In this corner, wearing green trunks, are value stocks. Value stocks are the underdog. They’re notable for trading below their intrinsic value. This is determined by measuring a company’s value based on revenue, earnings per share (EPS), dividend payout and any other underlying factors that could make an impact. Basically, they’re capable of punching above their weight.

And in the opposite corner, wearing black trunks, are growth stocks. In the battle of value vs. growth stocks, the betting line favors growth stocks… because they tend to have the sales growth to maintain upward momentum. But they also tend to be young and possibly inexperienced. After all, they’re supposed to have lots of growth left to achieve. And that’s especially true from an investor’s perspective.

Two of Our IU Einsteins Weigh-In

We recently sat down with IU Einsteins Karim Rahemtulla and Bryan Bottarelli to get their take on this very topic. Here is what they had to say…

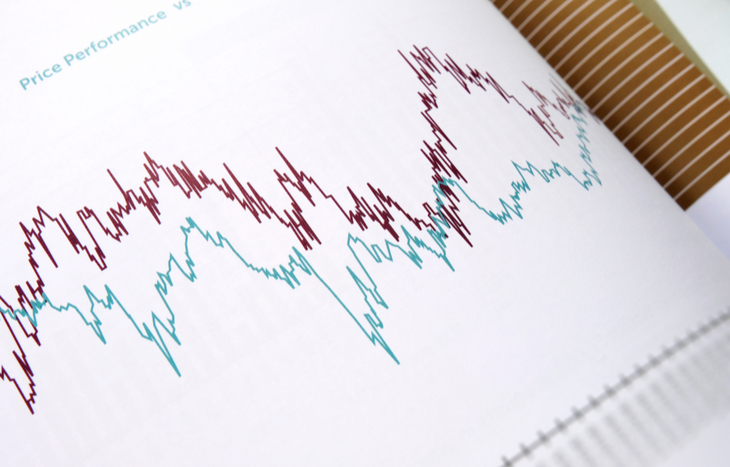

Bryan: “This shift that we see that’s happening right now. Growth stocks are becoming less attractive and going down. People are moving over into value stocks. There’s huge market implications today.”

Karim: “Okay, so listen, there’s growth, there’s crazy growth, and there’s growth that makes no sense. So let’s separate the three here, because growth stocks still will make money. You gotta be in the right ones. There’s hyper-growth stocks, which are creating 30 to 50 times sales, not earnings. Those are the ones that are gonna get creamed, because why would you pay 50 times sales for a company?”

Want to hear more of our Einstein’s take? Here’s the entire Growth Stocks vs. Value Stocks video…

Value vs. Growth Stocks: The Showdown

Next, let’s attach a face to the name of each of these…

A perfect example of a value stock is helmed by one of the most famous value investors in the world, Warren Buffett. Shares of his company, Berkshire Hathaway (NYSE: BRK.B), aren’t cheap by any means. But that doesn’t take away from their value.

This multinational conglomerate wholly owns household names like GEICO, Fruit of the Loom and Dairy Queen. It also has big holdings in the likes of Coca-Cola (NYSE: KO), Bank of America (NYSE: BAC) and Apple (Nasdaq: AAPL), among many, many others.

So a single share of Berkshire offers investors exposure to all of these companies as well as more than 100 additional ones. So it’s safe to say there’s a lot of value hidden in Berkshire stock. And you only need to look at the stock’s history to see that.

The stock has more than doubled the annualized returns of the S&P 500 for more than 55 years. From 1965 to 2018, shares of Berkshire Hathaway have returned 20.5% per year. Over that same time period, the S&P averaged an annual gain of 9.7%. So this value stock has certainly earned its reputation.

As for value stocks’ opponent, we’ll use Amazon as an example of a growth stock. Here’s why…

Amazon famously went years without turning a profit. Sure, the company was making money. But under the guidance of CEO Jeff Bezos, Amazon had no interest in impressing shareholders with cash on hand.

Instead, Amazon reinvested nearly every dime it made back into itself. This was a clear sign that Amazon was a growth stock.

Despite some profitless years, Amazon maintained a strong record of sales growth. And its innovative leadership kept Amazon ahead of the pack in the e-commerce space – which has been steadily growing for years in its own right.

Today, Amazon controls nearly 50% of all e-commerce. And as for investors who stuck with Amazon through the early years… well, they’ve been handsomely rewarded with a massive increase in share price.

In the 2010s, Amazon’s share price gained more than 1,300%. But naturally, the company can’t keep up that kind of pace forever. So it can’t be a growth stock forever. In fact, its growth years are most likely in the rearview mirror.

These days, Amazon’s diversified efforts are expected to bring in 20% of annual revenue growth… which will outpace most of its competitors in the same space, as well as the greater markets. But we’re unlikely to see massive four-baggers in years to come.

So there’s an argument to be made that Amazon has graduated from a growth stock into a value stock…

Which brings us to an important point…

A Diversified Portfolio Is the Great Equalizer

In the fight of growth vs. value stocks, there is no clear winner. The two could duke it out for all 12 rounds, and at best, you’d wind up with a split decision.

People who are looking for the next best thing or who are prone to homing in on new trends might be inherently better at finding new growth stocks. Those who find solace in crunching numbers and a slightly contrarian investment style might be better at finding value stocks.

But ideally, it’s best to split the difference. Just because it looks and acts like a growth stock doesn’t mean it will actually rocket upward. And on the other side of that coin, just because a stock appears undervalued doesn’t mean that it is.

And on top of that, the markets don’t really care what growth and value investors think. All the math and insight in the world won’t keep a stock from crashing and burning. The markets are fickle. That’s why diversification is vital to good investment strategy.

Growth stocks (especially in their early stages) come with more implied risk. There’s no promise that they’ll last. A CEO of a young company is only one scandal away from destroying his or her business. If a larger company with deeper pockets suddenly enters the same market as that growth-stock company, it could be curtains for them.

And investors who have all of their eggs in the growth-stock basket are opening themselves up to big potential losses… or giant gains. So it’s more of a gamble.

By including value stocks in their portfolios as well, investors are able to reduce the likelihood of their portfolios going belly up… while also gaining some exposure to new companies with massive upside potential.

The Bottom Line on Value vs. Growth Stocks

The next big investment opportunity could be right around the corner. Whether it’s a growth stock about to breakout, or a value stock that’s oversold, we want you to know all about it. The truth is, we don’t care what kind of stock it is as long as it’s making investors money… and is healthy enough to continue doing so in the future.

If you need help looking for your next big investment opportunity, sign up for the Investment U e-letter below. It’s the easiest way to find out the latest trends moving the market.

Read Next: 3 High-Growth Stocks to Watch

About Matthew Makowski

Matthew Makowski is a senior research analyst and writer at Investment U. He has been studying and writing about the markets for 20 years. Equally comfortable identifying value stocks as he is discounts in the crypto markets, Matthew began mining Bitcoin in 2011 and has since honed his focus on the cryptocurrency markets as a whole. He is a graduate of Rutgers University and lives in Colorado with his dogs Dorito and Pretzel.