Why Is Crypto Going Up? There Are Plenty of Reasons

Long- and short-term hodlers of Bitcoin (BTC) and Ethereum (ETH) rejoice. Bitcoin broke through its resistance point and breached the $50,000 mark for the first time since last May. And Ethereum is quickly approaching its all-time high. Nonetheless, many investors are asking the question, “Why is crypto going up?” The short answer is a rising tide lifts all boats. And the long answer isn’t that much more complicated.

Ethereum has been on an absolute tear since it activated its London hard fork. At the time, it was trading around $2,600 a coin. It’s since gone up close to 50% in value. And there are several reasons for this.

For starters, the software upgrade to the Ethereum blockchain slowed the supply rate that Ethereum grows at. In any market where supply is slowed down, you should expect to see a rise in value of the underlying commodity. And in the case of Ethereum, that’s been intensified by the fact that demand is on the rise.

Remember back in May when the Colonial Pipeline was hacked and the threat of a fuel supply led to panic buying… which resulted in raised prices? It’s sort of like that. Only in the case of Ethereum’s rise in value, there’s no panic buying. It’s simply growing increasingly important.

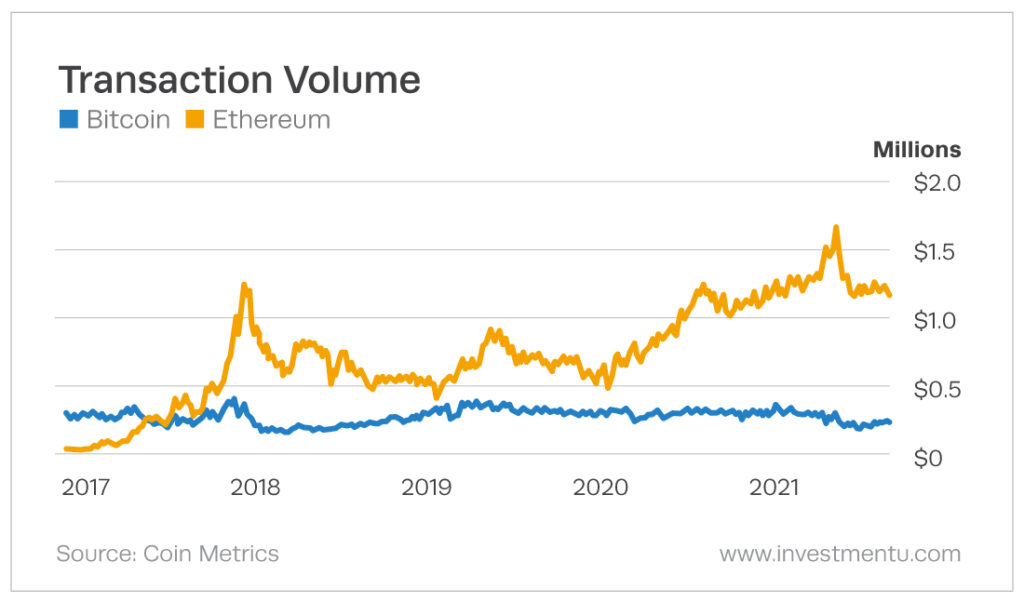

The Ethereum economy has boomed with growing interest in the NFT (non-fungible tokens) marketplace. But it’s not just Ethereum’s outsized role in NFTs that has been propelling it higher. On top of this, the number of crypto-based lending, savings and trading apps has also rapidly scaled up. And that’s also good news for Ethereum. But that’s not the only answer to the question, “Why is crypto going up.”

Why Is Crypto Going Up? Ask The Institutional Investors

Payment companies like Square (NYSE: SQ) are working toward a decentralized finance (DeFi) business model. Then there are the Wall Street giants like BlackRock (NYSE: BLK) and J.P. Morgan Chase (NYSE: JPM). Leading up to crypto’s 2020 surge in value, institutional investors made up less than 10% of all DeFi transaction volume. In the second quarter of 2021, they make up 60% of that volume.

The big boys are taking a real shine to crypto these days. That’s likely to make prices even more competitive going forward. And among the two biggest coins, Ethereum is getting the most attention from traders… At least for now.

Then there was an announcement that went under the radar of many crypto traders. A group of some of the leading Ethereum-based DeFi projects banded together to form a “global crypto organization” with the goal of bringing DeFi to six billion smartphone users around the world. While partnerships built around decentralizing something might seem like an oxymoron, in this case, it seems to make a lot of sense. And is yet another catalyst behind the question why is crypto going up.

This project, called DeFi for the People connected the likes of Aave, SushiSwap, Curve, PoolTogether and Celo to help raise awareness of DeFi through $100 million in grants and incentives. And it couldn’t have come at a better time. El Salvador just became the first country to adopt a cryptocurrency as legal tender… And things didn’t exactly go perfectly.

Is El Salvador Ahead of the Curve?

For the uninitiated, the first steps towards understanding and using crypto can be quite a chore. But if a bunch of over-the-hill bankers can figure it out, there’s little doubt that the people of El Salvador will eventually figure it out as well. Especially when it has the chance to save them so much money.

El Salvador’s crypto adoption could finally give Salvadorans access to financial service – which according to the latest figures, less than 65% of the country currently has. On top of this, widespread crypto adoption could help save those from El Salvador $400 million in remittance fees. That’s a huge chunk of change for a country that is one of the poorest in the western hemisphere. For reference, the national gross income per capita in El Salvador is right around $4,000.

However, for digital currencies to work, connectivity is key. Nearly half of the population has no internet. And even more have only sporadic access. All of this is going to make widespread adoption difficult. Then there’s the fact that Salvadorans are more than a little wary of the characteristic volatility of crypto.

Nonetheless, the plan is in motion. Leading up to the country’s release of the Chivo digital wallet (which hit a few snags), the country bought 400 bitcoins. That amounted to around a $20 million investment for the country. The move was made in order to give everyone who downloads the wallet $30 in Bitcoin. That gave a nice little bump in Bitcoin’s value along the way. And is yet another answer as to the question why is crypto going up.

Why Is Crypto Going Up: The Bottom Line

As we’ve pointed out before, crypto is the very definition of a headline-driven market. And of late, the headlines have been good. They’ve been the kind of headlines that sent Bitcoin on a 275% rise in value last year.

But it’s worth remembering that in last year’s crypto bull run, Bitcoin lagged behind a lot of the competition. It was clearly among the leaders in attracting investment money. But it came far short of providing the biggest return. That award goes to AAVE – which spiked 9,500% last year. So, when it comes to the question, why is crypto going up, there are a lot of reasons. But it requires a much closer look to find the tokens that are poised to go up the most.

If you’re looking for the next token to take the crypto world by storm, we suggest signing up for Manward Financial Digest. In it, Andy Snyder helps guide new and seasoned investors through the crypto markets to find investment opportunities that best fit their portfolio and risk tolerance. All you have to do is enter you email address in the box below to get started.

About Matthew Makowski

Matthew Makowski is a senior research analyst and writer at Investment U. He has been studying and writing about the markets for 20 years. Equally comfortable identifying value stocks as he is discounts in the crypto markets, Matthew began mining Bitcoin in 2011 and has since honed his focus on the cryptocurrency markets as a whole. He is a graduate of Rutgers University and lives in Colorado with his dogs Dorito and Pretzel.