What Is Chainlink Crypto, and Is It a Good Investment?

This week a whole lot of investors have been asking Google what the heck is LINK. That part’s easy. LINK is the ticker for the Chainlink crypto token. This is an Ethereum-based token that helps power the Chainlink decentralized oracle network.

To clarify, oracles exist to connect blockchains to external systems. This helps blockchain technology function in real world applications. They enable smart contracts to be executed based on information from verified applications beyond the blockchain.

To unpack this a little further, the Chainlink network permits smart contracts on the Ethereum blockchain to be securely connected to outside payment systems and application programming interfaces (among other things). Networks like this play an invaluable role in pushing forward the usefulness of both cryptocurrency and blockchain tech. And Chainlink in particular has grown increasingly popular in the Decentralized Finance (DeFi) community.

The co-founder of the popular decentralized exchange Trader Joe noted that a commitment to security is why it chose Chainlink as its oracle of choice. The decentralized exchange DODO also uses the oracle powered by Chainlink crypto. But these are just a couple of applications that use it.

The Chainlink network has also been used in derivative trading mechanisms, money markets and even for streamlining the staking process. So obviously, the use cases for Chainlink are plentiful. But does that make Chainlink crypto a good investment? That part’s a little more complicated.

Should You Buy Chainlink Crypto?

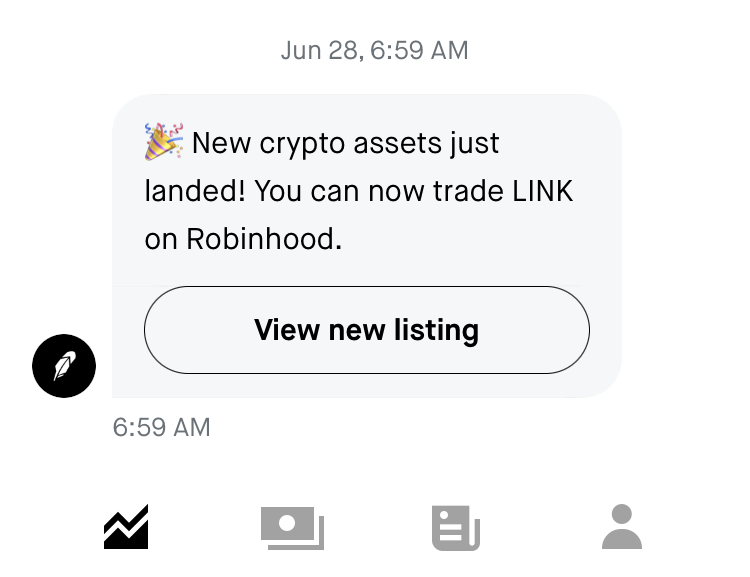

Here at Investment U, we’ve been fans of Chainlink crypto for some time. We’ve included it on previous lists of cheap cryptocurrencies to buy. And we’ve made note of it as being one of the most popular altcoins last year. But if you missed those, you’re probably here because you’re one of the millions of Robinhood users that got a message that looked like this:

Look familiar? If so, you’re probably wondering if you should pick up a few tokens. Or maybe you already jumped at the opportunity and you’re wondering if you did the right thing. Well, we’re here to help.

If you saw that early morning message from Robinhood and jumped at the opportunity to buy Chainlink crypto right away, you’ve likely seen some quick ups and downs from your investment. But fret not, this is actually pretty normal.

When an exchange adds a new crypto token to its list of offerings, that token often sees a big spike in interest. That pushed the price higher (naturally). And those that had already been holding it, sometimes sell it after the quick spike in price. This is usually only done by either very active traders or those that use crypto bots with their portfolios. Either way though, it can be disheartening. But keep your chin up. There’s more to this story than just some short-term losses.

In fact, if you’re into this investment for the long-haul, there’s an excellent case to be made for Chainlink crypto being included in your portfolio. But we’ll include a couple of caveats as well.

Isn’t Crypto Fever Over?

Yes. Once again, crypto has fallen out of favor with a lot of retail investors. We’re in what is colloquially known as a crypto winter. Prices of many of the major crypto assets are trading at or below 70% of their all-time highs. And Chainlink crypto is no exception. It hit a high of $52.88 last year… Before losing close to 90% of its value. So the good news is you’re not buying Chainlink crypto at a high right now.

But that’s just part of the cycle. Us old-timers that have been keeping an eye on crypto for a while can remember when Bitcoin crashed in 2011. It lost 40% of its value in what seemed like the blink of an eye. It dropped all the way down to $0.67 a coin – after recently cresting the $1.06 mark.

Then of course, there was the crazy bull run in 2017. A single Bitcoin went from being worth $900 all the way to $20,000… Before the bottom fell out in early 2018. And last year we saw the same thing happen again.

If you could have bought the dip in Bitcoin at any of those time, would you have? Sure we have the gift of hindsight now, but we’re in the midst of similar phenomenon. Crypto is down now. But it’s far from out. That’s why we think now is an excellent time to buy Chainlink crypto. It’s selling at a discount. And because it helps power one of the most powerful and popular oracles out there, it’s safe to say it’s not going away any time soon.

About Those Caveats…

There are some notable exceptions to whether folks should invest in Chainlink crypto though. For short-term traders, we don’t think it makes a lot of sense. If you’re looking for big price spikes in the next couple of weeks (or even months), this probably isn’t an investment for you.

Furthermore, if you’re a little tight on cash right now, Chainlink crypto might not be a great store of your capital. We expect to see continued volatility in the crypto markets for a while. And that could lead to some losses. If you can’t afford the losses right now, steer clear.

The one other caveat we’d like to mention is that Robinhood isn’t the ideal crypto exchange. Investors that use this brokerage don’t actually own the cryptocurrencies they buy on it. Robinhood does. Those that invest in crypto using Robinhood are simply betting that the price of the coin will go up with the hope of selling it in the future for a gain.

If that’s fine by you, have at it. But if you’re looking to actually buy and hold a cryptocurrency, there are a number of exchanges better suited for that. Coinbase is an exceptionally easy crypto exchange to navigate. And Binance is one of the most popular exchanges in the world. Those are just two possibilities though. A quick Google search will serve you up scores of other ones if these don’t do it for you.

The Bottom Line on Chainlink Crypto

If you’re new to cryptocurrencies and wondering if now is a good time to dip your toe into the market, we think you could do a lot worse than Chainlink crypto. The system it helps power has become an invaluable resource in DeFi. And it hasn’t been trading as cheap as it is now for quite a while. Is there room for it to drop further? Of course. But in the coming years, we expect Chainlink crypto to recover and eventually hit new all-time highs. And that would equate to a more than 700% gain.

That being said, there’s nothing certain in the world of cryptocurrencies. A new operation could come along that dethrones Chainlink from its spot as a favorite oracle network. But what it does, it does very well. And we think it’s more likely that future use cases will be added to the list of things Chainlink does well. So while it’s still speculative in nature, the future of Chainlink crypto looks very promising.