Best Coal Stocks to Sell in 2022

I’m all for a renewable energy future… but I’m also a pragmatic investor. We still need fossil fuels to meet our energy demand. That’s why I’ve been keeping an eye on energy trends and the best coal stocks.

But after the recent rebound in the energy industry, it’s a much better time to sell. Investor sentiment has changed and valuations are much higher. Even if energy prices remain elevated for a while, it’s harder to justify the higher share prices.

For a useful comparison… back in 2020, I invested close to 10% of my life’s savings into Exxon Mobil (NYSE: XOM). At that time, prices were low and many investors were avoiding energy companies. There were non-stop negative headlines for the fossil fuel industry.

It wasn’t easy to go against the crowd, but over the past two years, fuel prices have climbed and sentiment has changed.

Investing in fossil fuels in 2020 was a contrarian move, but that isn’t the case today. That’s partially why I sold my entire Exxon Mobil position at the start of June 2022. I locked in more than a 100% gain.

There’s a lot that went into this decision and if you’re considering what to do with coal stocks, this insight might help…

Fossil Fuels Trends

Fossil fuels are more energy dense and cost effective than many alternatives. That’s why they still make up the majority of our power today. And we’ve built up impressive infrastructure to mine, process and move fossil fuels.

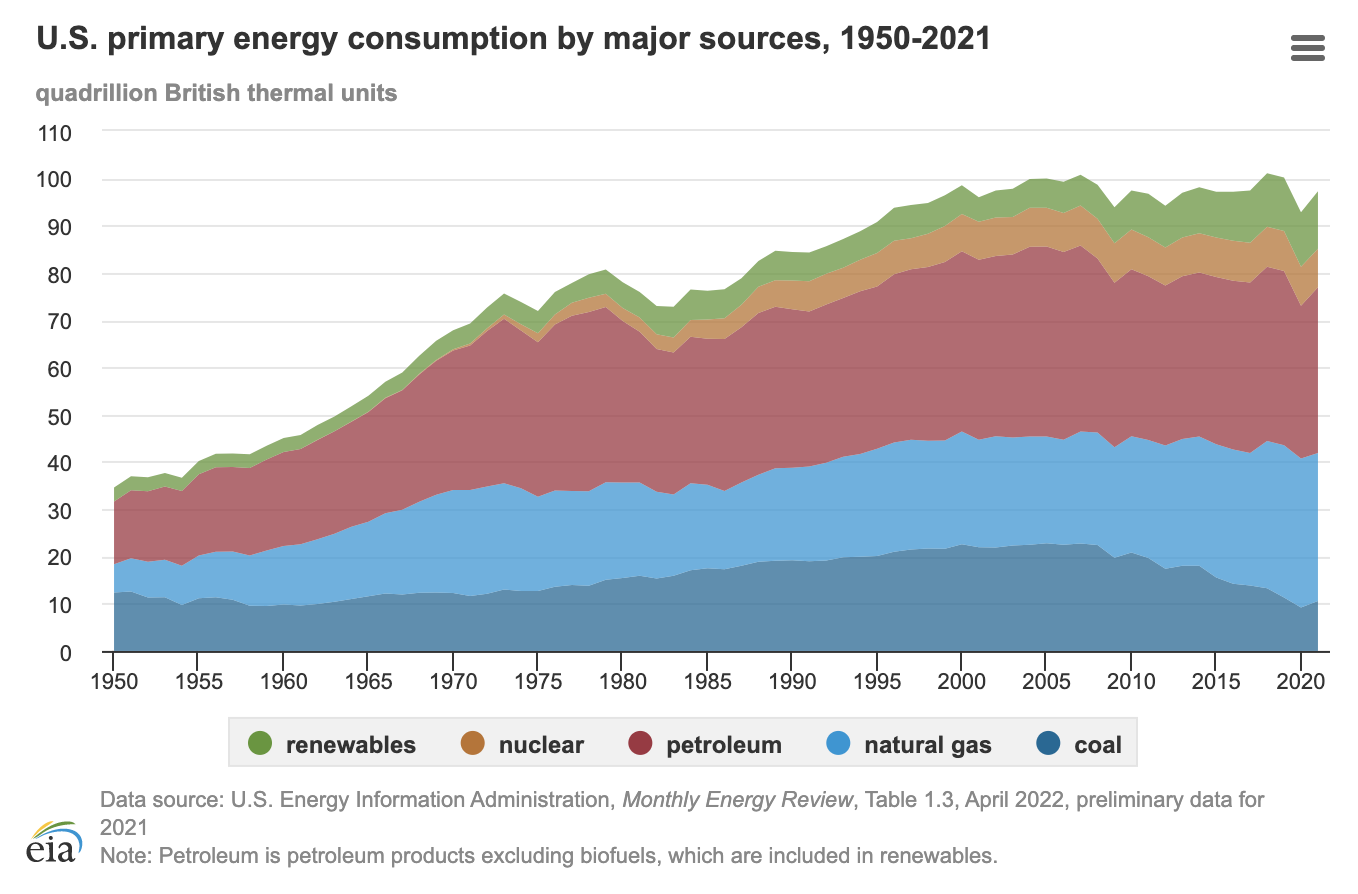

According the EIA, fossil fuels made up close to 80% of total U.S. consumption in 2021. And the chart below shows primary energy consumption by major source. You can see the annual changes since 1950…

Even though we’ve seen a lot of renewable energy innovation – and headlines – it only makes up a small piece of the total. It’ll likely take a decade or more to overtake fossil fuel production. And a quick side note, here are some uranium stocks to consider.

When looking at energy from coal, it’s dropped for more than a decade. But in 2021, it still made up more than 10% of the total. That’s big money for the industry and it’s helped push the best coal stocks as energy prices have climbed higher.

Coal Companies and Global Demand

When it comes to coal, it’s cheap but worse for our environment. That’s why the U.S. and many developed nations have pushed against it. But with developing markets such as China and India, coal is still in high demand.

According to the National Bureau of Statistics of China, the consumption of coal increased 4.6% in 2021. And coal accounted for 56% of the total energy consumption.

When looking at the trends, it’s clear that coal and fossil fuel companies will continue to profit for many decades. Although, as a value investor, we must always look at the price we pay relative to the underlying value.

Selling Coal Stocks

If you’ve bought any of the coal stocks below in the past year or two, it might be a good time to sell…

- Consol Energy (NYSE: CEIX)

- Peabody Energy (NYSE: BTU)

- Alpha Metallurgical Resources (NYSE: AMR)

- Natural Resource Partners (NYSE: NRP)

- Ramaco Resources (Nasdaq: METC)

- Alliance Resource Partners (Nasdaq: ARLP)

- Warrior Met Coal (NYSE: HCC)

- Arch Resources (NYSE: ARCH)

- SunCoke Energy (NYSE: SXC)

With strong demand and higher energy prices, their financials are improving. Although, how long will that last? And more importantly, the runup in company valuations has likely outpaced their fundamental growth potential.

For example, some of these stocks have climbed more than 1,000% in the past two years. There’s been a clear shift from investor pessimism to optimism.

I’m not saying these will necessarily be bad investments going forward. Instead, one major reason to consider selling is higher opportunity costs. As oil and coal stocks have run higher, stocks in other industries have dropped.

On top of that, there is some very long-term uncertainty for the entire coal industry. Even through public outcry against coal has recently dropped, it could easily resurge in the coming years.

Final Thoughts on Coal Stocks

In the short-term, I’m not sure which way coal stocks will move. Timing a top or bottom consistently is impossible to do. Warren Buffett can’t do it and neither can I. Instead, it’s more useful to look at the long-term trends and how asset valuations compare today.

Anything for the right price can be a great investment. But I don’t think coal stocks come in at the right price today. On top of that, and as mentioned, there’s a higher opportunity cost. As energy stocks have climbed higher, stocks in other industries have dropped.

To find better industries and stocks to invest in, consider signing up for these free investment newsletters. They’re packed with insight from market experts that may help you make better investment decisions.