The China Crypto Ban Tanked the Market… but a Recovery Is Coming

News of a China crypto ban positively rocked the markets. Bitcoin experienced a 40% crash in value. And the crypto market as a whole underwent an estimated $1 trillion loss in market cap. Anyone who’s been in the crypto game for a while knows that investors can be a reactionary bunch. And the crypto crash obviously spooked some investors. This is a perfect example of knee-jerk selling. However, it also means that this correction should itself be corrected pretty quickly.

Here’s the Reuters headline that sparked it all:

China bans financial, payment institutions from cryptocurrency business.

This headline was the second part of a one-two punch on all things crypto. It came shortly after Tesla CEO Elon Musk announced that the electric vehicle maker would no longer accept Bitcoin as payment. Musk’s decision was due to environmental concerns.

To be clear, I strongly believe in crypto, but it can’t drive a massive increase in fossil fuel use, especially coal

— Elon Musk (@elonmusk) May 13, 2021

Sure, that tweet didn’t do Bitcoin investors any favors. But it was the latest Reuters headline that really did a number on crypto markets worldwide. This is where it gets interesting, though. When I asked crypto expert Andy Snyder about the news, he clarified a crucial detail.

Well, it’s not exactly news. What’s happened is a few Chinese watchdog agencies issued a warning about the speculative nature of crypto. That’s nothing new.

In fact, no new laws or rules were passed. The agencies merely restated laws that have been in place since 2013 – when Beijing announced Bitcoin was not a real currency and financial institutions could not transact with it.

On top of this glaring omission, it’s worth noting that the 2013 law mentions only Bitcoin. The thousands of other coins in circulation aren’t even mentioned. This should be seen as good news. But it’s safe to expect a whole lot more headlines before this is all straightened out.

News of the China Crypto Ban Brings Opportunity for Some

There are two ways to look at this massive decline in the crypto market. News of the China crypto ban and the price declines will be confirmation for the naysayers. The I-told-you-so crowd was quick to suggest this will be the end of crypto as we know it. And the fully indoctrinated saw the latest crypto crash as an opportunity to buy the dip. After all, we haven’t seen prices this low in quite some time. So, who’s right?

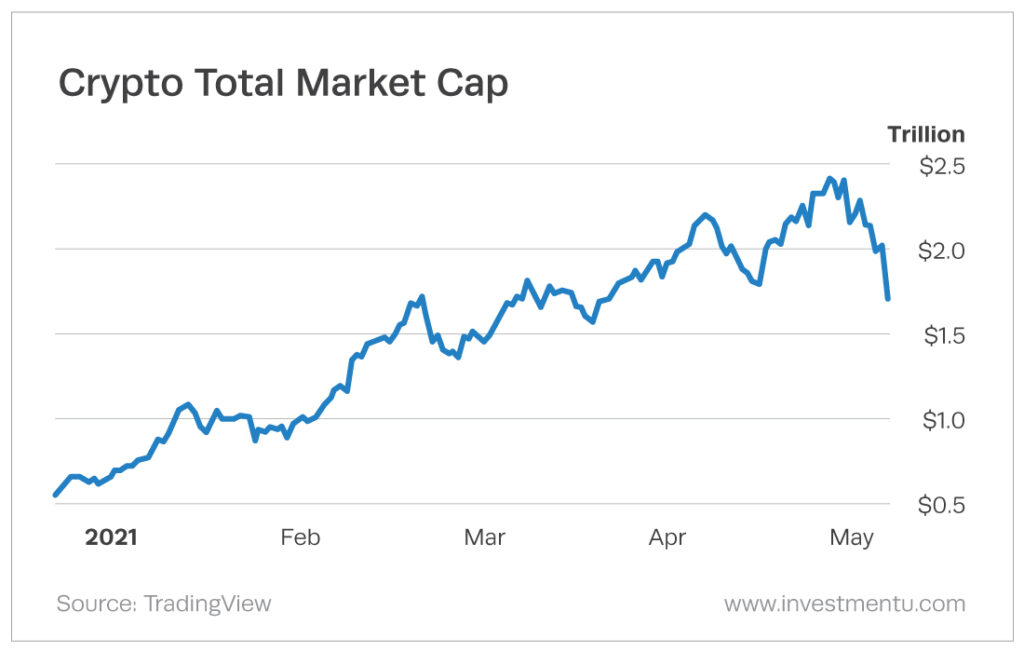

The truth is that the “China bans crypto” headlines will continue to circulate for a spell. But we’ll also get better analysis along the way. And crypto investors should find solace in the fact that Bitcoin’s floor stayed above the $30,000 mark. That means this flash crash is nowhere near as disastrous as the Bitcoin crash of 2018, when its price fell 65% in a month. And as you can see below, crypto is still far above where it started the year.

Nonetheless, when an entire asset class gets pummeled like this, there is cause for concern. I know I broke out in a little sweat after seeing the charts. That means a modicum of caution should be exercised.

Applying a “Yellow Light” Strategy

The other big question I had for Andy Snyder was how he plans to proceed going forward. He expects opportunistic buyers will take the queue and jump in. But how long it will take to reflate the crypto market is a big unknown. That’s why Andy is suggesting a “yellow light” strategy.

That means it’s time to proceed with caution. And now might be a good time to refresh your selling strategy. But that comes with a caveat.

Historically, long-term holds have produced the biggest crypto gains for Andy – by a fair margin. Holding through the volatility and seeing where this all goes has proven exceptionally effective. And, as he points out, there’s something else to consider here after news of the China crypto ban…

The money flow we’ve been tracking and taking advantage of has declined rapidly. But that doesn’t mean all the institutional buying, all the plans for new exchange-traded funds and all the investments by some of the biggest companies on the planet will suddenly disintegrate.

In many ways, the smart money is drooling today. The market just got a LOT cheaper.

His advice to the crypto crowd is to hold tight. A rebound is likely. But a single tweet or another salacious headline is all it will take to trigger another drop. This is a very headline-driven market. And if more details about a China crypto ban come out, it makes sense to be prepared for another dip. But if you’ve been in the crypto market for more than a few days, you’ve probably already developed some level of immunity to volatility.

The Bottom Line on the China Crypto Ban

Volatility is baked into the crypto market. We’ve seen similar overreactions when news of India banning crypto came out. And it’s not out of the realm of possibilities that a more official China crypto ban is in store. As the country continues to roll out its own digital yuan, it would make perfect sense for it to try to remove the competition. But for now, that’s nothing more than speculation.

Speaking of speculation, if you’d like to follow Andy’s advice and see how he’s navigating the world of crypto, we highly recommend signing up for his Manward Financial Digest e-letter. All you have to drop your email address in the box below. And if you’d like to get a little taste of what Manward has to offer first, he’s put together an extremely useful crypto cheat sheet that rookies and veterans alike can learn a lot from. All you have to do is click the link above.

About Matthew Makowski

Matthew Makowski is a senior research analyst and writer at Investment U. He has been studying and writing about the markets for 20 years. Equally comfortable identifying value stocks as he is discounts in the crypto markets, Matthew began mining Bitcoin in 2011 and has since honed his focus on the cryptocurrency markets as a whole. He is a graduate of Rutgers University and lives in Colorado with his dogs Dorito and Pretzel.