The 5 Best Cryptocurrencies to Invest in for 2022

The best cryptocurrencies… the mere thought of such a list is enough to make some investors snicker and then dismiss the topic altogether.

Case in point: Investing rock star Warren Buffett has called Bitcoin rat poison, a mirage and worthless. He has also noted that cryptos are basically worthless because “they don’t produce anything.” We’d like to offer a rebuttal of that here and here. But we don’t have any illusions that minds will be changed.

Carl Icahn has gone on record describing cryptocurrencies as “ridiculous.” But at least he also noted that he just might be too old to understand them.

Dallas Mavericks owner Mark Cuban has said that he’d rather have bananas than Bitcoin… After all, at least you can eat bananas. But you could also trade a single Bitcoin for more than 150,000 bananas. So that might not be the sagest advice Mr. Shark Tank has imparted. It’s also worth noting that he estimates 80% of his investments are now crypto-related. It’s nice to see that his strategy has changed with the tides.

Then there’s JPMorgan Chase CEO Jamie Dimon. He’s referred to digital currency as a “fraud.” He also said that people stupid enough to buy it will pay the price for it in the future. He was close… It turns out Bitcoin investors have been paid a price – and a substantial one at that. He’s also changed his tune on crypto over the past couple of years.

Even “the fools” who jumped in on Bitcoin during its 2017 highs have now seen a return on their investment. That is if they were wise enough to hold. That being said, it did take a few years. And those who waited for the 2017 crypto frenzy to die down have been even luckier.

If the past two years has proven anything, it’s that cryptocurrencies more lasting power than the naysayers thought. So a list of the best cryptocurrencies is a worthwhile endeavor.

So without further ado, here are…

The Best Cryptocurrencies to Invest In 2022

- Bitcoin (BTC)

- Ethereum (ETH)

- Litecoin (LTC)

- Binance Coin (BNB)

- Solana (SOL)

There are roughly 8,000 different cryptocurrencies out there. And a whole lot of them aren’t worth the space they take up on your hard drive. Take internet darling Dogecoin for instance. Sure it had a stellar year in 2021. But it’s one of those tokens that really doesn’t do anything. And with a virtually unlimited supply, demand is unlikely to keep up with supply for very long.

But this also helps explain part of the draw of cryptocurrencies. There are plenty of folks out there who threw a couple hundred bucks at it when it was worth a fraction of a cent. A few of years ago, a single Dogecoin was worth $0.001774.

Fast forward a couple years and a buy-and-hold strategy (or hodl, if you will) would have brought in gains upward of 8,9000%. That’s a solid return no matter what kind of investment it is. But that type of return shouldn’t be expected. It’s an outlier at best. And that brings us to the best cryptocurrencies to pick up and “hodl” for the foreseeable future.

Bitcoin (BTC)

Sure, it’s the most obvious one. But that’s for good reason. Afterall, there’s something to be said for the cryptocurrency that started it all. With a market cap of more than $800 billion, it’s without a doubt the strongest cryptocurrency out there.

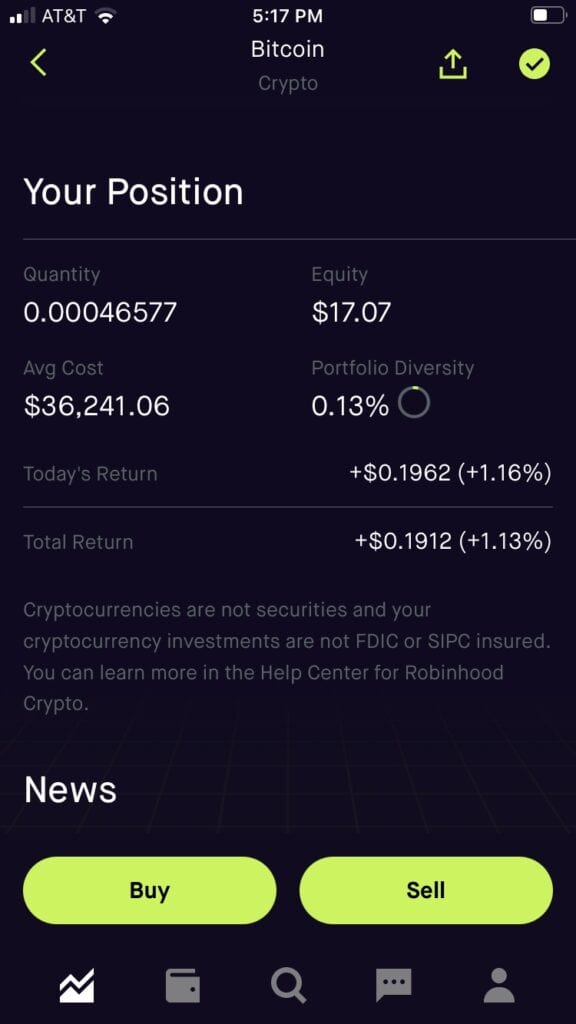

Its steep price keeps many potential investors on the sideline. But that needn’t be the case. For instance, here we are (below) picking up $17 worth of Bitcoin in a Robinhood account. While Robinhood isn’t the preferred way to invest in crypto, this example does highlight the simplicity.

Sure, that scored a quantity of only 0.00046577 Bitcoin back when it was trading for arounf $36,000 a token. But that small holding stills grants exposure to the most prominent cryptocurrency out there.

Ethereum (ETH)

For every Batman, there’s a Robin. And while Bitcoin rules the crypto roost, Ethereum is a potent second fiddle with lots of upside potential. Like Bitcoin, Ethereum is seen by enthusiasts as an alternative to fiat currency. But its blockchain technology is more focused on decentralized applications and an NFT marketplace than digital currency. But that hasn’t slowed this altcoin’s rise in value.

While operating as a software platform, it enables decentralized applications to be built and run without fraud or third-party interference (take that Apple and Google). The applications that run on its platform operate via its own cryptographic token. That makes this crypto sought after by developers looking to improve and run apps within this network. And on top of that, is the the kingdom of NFTs. At least for the time being.

Ethereum also happens to be one of the most popular cryptos that can be used on exchanges to buy other cryptocurrencies. While its market cap is still less than half of Bitcoin’s, it has slowly been making headway. And with momentum on its side, Ethereum is an easy pick for one of the best cryptocurrencies available.

Litecoin (LTC)

Founded by former Google employee Charlie Lee, this crypto shares a lot of similarities with its big brother, Bitcoin. It was developed with the intention of improved transaction times (roughly 2 1/2 minutes) and lower transaction fees. It has a substantially faster block generation rate than Bitcoin. And unlike most cryptos, the list of merchants that accept Litecoin is growing rapidly.

As Litecoin usage becomes more commonplace, it stands to reason that its value will only grow. And that makes this one of the best cryptocurrencies out there… whether you want to hold it and watch it grow or use it as a form of payment.

Binance Coin (BNB)

Binance is the largest cryptocurrency exchange in the world based on volume. And it’s not even close. Binance Coin (BNB), naturally, is the official token of the Binance exchange. It allows users to trade in other cryptos with seamless efficiency. Binance Coin can also simplify transaction fees and even pay for goods and services. There is even a Binance Card available now. This allows folks to pay for things just like they would with their regular credit card. The only difference is that they load up the card with Bitcoin or Binance Coin to pay for groceries or a new crypto hard wallet.

Based on usability alone, Binance Coin is easily one of the best cryptocurrencies available. It’s also the preferred token for trading on popular decentralized exchanges like PancakeSwap and Kyber Network.

Solana (SOL)

When we first checked out Solana, this project looked like it could hit it out of the park. And while it’s currently trading about 53% its all-time-high, our thesis hasn’t changed. That’s in part due to the fact that it’s up more than 7,800% compared to this time last year.

But on top of that, we really like its use case. The blockchain behind Solana set out to revolutionize the crypto market. And by some accounts, it’s succeeded. Its scalability, low transaction fees and breakneck confirmation speeds leave us in awe. And on top of that, we think it’s currently trading at a discount.

The Not-So-Great Cryptocurrencies to Date

Two of the biggest cryptos out there that didn’t make this list missed it for two big reasons. One is under investigation. The other doesn’t exist yet.

Ripple (XRP) has been one of the most widely known cryptos for years. It’s had ups and downs in value just like the others. But while many cryptos are surging upward, Ripple is floundering in a big way. At the end of 2020, Ripple took a big hit, and it’s uncertain how long the damage will last. But in all likelihood, it’ll be for a while.

The Securities and Exchange Commission (SEC) filed suit against Ripple Labs and two of its executives at the end of 2020. The suit alleges that $1.3 billion were raised through an unregistered digital asset security offering. That’s a big no-no. And the price of Ripple has dropped dramatically. Will it return to its former heights? That remains to be seen. But for now, investors should steer clear. Or at the very least, they should be extremely wary.

Then there’s Diem (formerly known as Libra). It may be the most hyped-up crypto ever. Heck, it’s responsible for Congress trying to wrap its collective brain around what exactly cryptocurrency is. While it’s no shocker that our politicians are still largely in the dark, the opportunity afforded Facebook’s future cryptocurrency lots of time in the spotlight. And when it’s released sometime this year, it wouldn’t be too shocking if name recognition rewards early adopters.

The Bottom Line on the Best Cryptocurrencies to Invest in This Year

There’s a lot of competition out there in the world of cryptos. And volatility is a characteristic of many of them. That’s why this list of the best cryptocurrencies is mostly intended for the buy-and-hold crowd. With maybe the exception of Binance Coin – simply due to its convenience – ignoring daily and weekly price swings might be in your best interest.

If you’re looking for faster opportunities… and the chance to get in and out of altcoins a little faster and turn a profit, we suggest signing up for the Manward Digest e-letter. This will give you easy access to a whole new world of investing and the chance to discover fast-moving cryptocurrencies with tons of upside potential.

About Matthew Makowski

Matthew Makowski is a senior research analyst and writer at Investment U. He has been studying and writing about the markets for 20 years. Equally comfortable identifying value stocks as he is discounts in the crypto markets, Matthew began mining Bitcoin in 2011 and has since honed his focus on the cryptocurrency markets as a whole. He is a graduate of Rutgers University and lives in Colorado with his dogs Dorito and Pretzel.