How to Invest in Gold in a Volatile Market

Market volatility seems out of control. The markets move a thousand points up or down per day. Gold can be seen as a safe harbor in these turbulent times. But if you don’t know how to invest in gold, we’re here to help.

Gold is a commodity. That means it’s a basic economic good that is completely interchangeable with other instances of the same stuff. Other commodities in the investing market include platinum and other precious metals. Oil. Soybeans. Lumber. And more.

Stocks have been on an incredible run over the last decade. Since February 2009, the S&P had surged 250%. If you include dividends paid, that increases to more than 300%.

But these high times for stocks seem to have reached a period of extreme volatility. The markets go in cycles. Stocks will come back up. But they’ve had a rough month. But here’s some good news.

Investing in Gold as a Safe Haven

During the dot-com bust, gold began an incredible bull run. The price of gold surged from $300 per ounce in late 1999 to almost $2,000 per ounce a decade later, as financial guru of Manward Press Andy Snyder has pointed out.

During a bearish stock market, gold has proven time and again to be a true safe haven for your money. You can see how well investing in gold would have helped you in 1999. And it can help your portfolio again now.

One of the most important principles in all of investing is portfolio diversification. Spreading your savings across stocks and different asset classes helps lessen your risk.

When stocks are flying high, diversification may seem silly. But in bear markets, having some of your money invested in gold can be a brilliant move.

Gold’s Correlation With Stocks

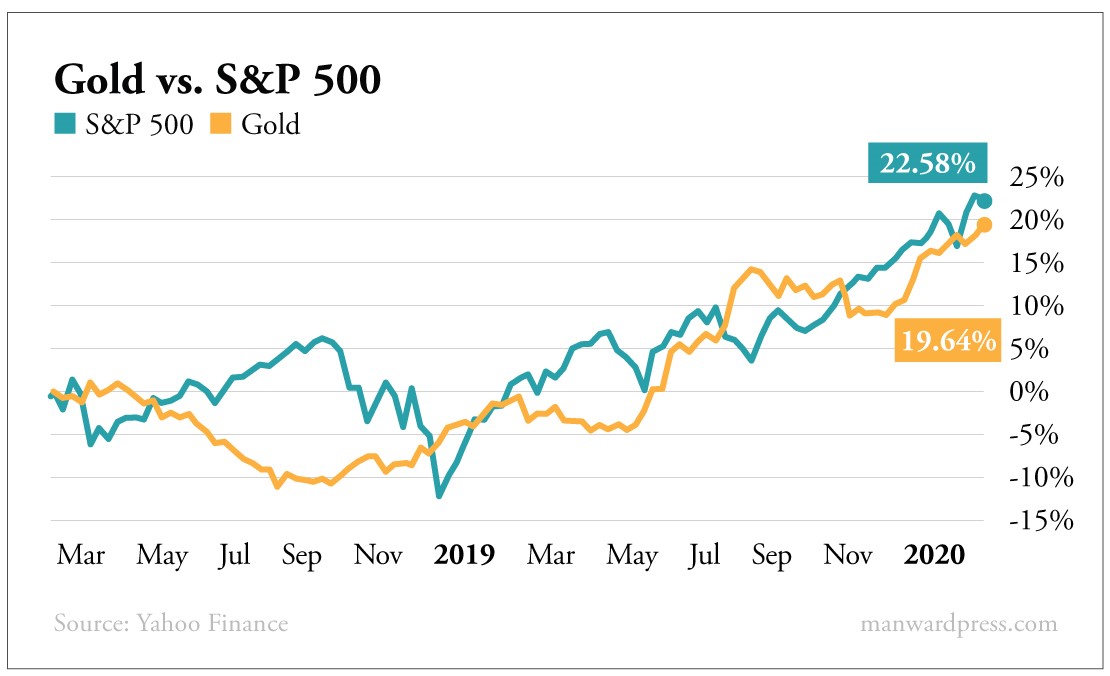

Andy Snyder has been touting gold for months now. Stocks had been up in the bull market, way up. But so was gold. It nearly kept pace with the S&P 500 for two years as seen in the chart below:

It’s time to start thinking differently about gold. It isn’t meant to be just a mere sliver of your portfolio. It should be a cornerstone.

Gold has shown it can do well when the stock market is up. And we know that gold does well when the stock market is down. Treating gold the way it was treated 50 years ago, as an afterthought, is no longer an option.

Andy Snyder wasn’t the only financial expert who caught on to the gold rush. Expert stock trends analyst Matthew Carr also caught on.

As Carr says, “Gold loves uncertainty. And right now, we’ve got plenty of it.”

The wild swings in the stock market lately indicate uncertainty about the broader economic environment. Uncertainty about the coronavirus. About interest rates. About elections. Trade wars. And more.

But as Carr says, gold loves uncertainty. Which is why it is going to continue to thrive right now. It is protection against the wild volatility of the current stock market.

Different Ways to Invest

If you’re wondering how to invest in gold, the truth is there are several ways. Let’s look at some of the different ways you can invest now:

-

Physical Gold

.

You can purchase physical gold itself. Gold can come in the form of jewelry. Coins. Or bullion, like gold bars. There are a number of things to keep in mind when buying physical gold.

.

For starters, you will have to pay a premium of up to 10% over the spot price of gold, though often lower. Plus, you will need a way to store it. A bank vault can be a convenient way to do this, but this is an additional cost as well.

.

When buying physical gold, be careful to make sure it is authentic. You don’t want to be the fool who buys the fool’s gold.

. -

Gold Futures

.

Futures contracts allow you to buy or sell an asset at a specified time in the future at a particular price. Futures contracts trade on exchanges like stocks, bonds and options.

.

Now, each day a futures contract is marked-to-market. This means that when the price of gold increases during the life of the contract, you earn a profit. But when it goes down, you have a loss.

.

Another thing to keep in mind is the initial margin. When you buy a futures contract, you don’t lay out the full price of the asset. You lay down a percentage, which is called the initial margin.

. -

Gold ETFs

.

Buying a gold exchange-traded fund (ETF) is like buying other stock ETFs. They trade on the exchanges just like stocks. And they give you broad exposure to gold and instant diversification.

Gold ETFs can be a great way to go for inexperienced investors who want exposure to gold. One of the most popular gold ETFs is the SPDR Gold Shares (NYSEArca: GLD).

Its year-to-date performance is up about 7%. Compare that with the S&P 500’s, which was down more than 11% over the same period – and is dropping today.

-

Gold Stocks

.

Instead of purchasing a gold ETF, you can also invest in individual gold stocks. We put together a list of the top gold stocks to watch in 2020.

.

The list includes gold mining companies ordered by their total market capitalization. A few of the standout companies on the list include Kirkland Lake (NYSE: KL) as well as Yamana Gold (NYSE: AUY).

Some Final Thoughts

The markets are currently turbulent. They are full of volatility. And markets hate uncertainty. Even the most risk tolerant of investors don’t like to see these kinds of daily swings.

But when the door to one opportunity closes, another opens. There are stocks that will continue to do well despite the bear market.

But not everyone will have the stomach to put more money into stocks right now. For those of you who may fit that bill, or just want some extra diversification, gold has become an attractive opportunity.

Once you know how to invest in gold, the choice becomes yours as to how to do it. Whether you choose physical gold, futures, ETFs or individual gold mining stocks, there’s still lots of money to be made out there starting right now. To learn much more about investing in gold, sign up for our free e-letter today.

About Brian M. Reiser

Brian M. Reiser has a Bachelor of Science degree in Management with a concentration in finance from the School of Management at Binghamton University.

He also holds a B.A. in philosophy from Columbia University and an M.A. in philosophy from the University of South Florida.

His primary interests at Investment U include personal finance, debt, tech stocks and more.